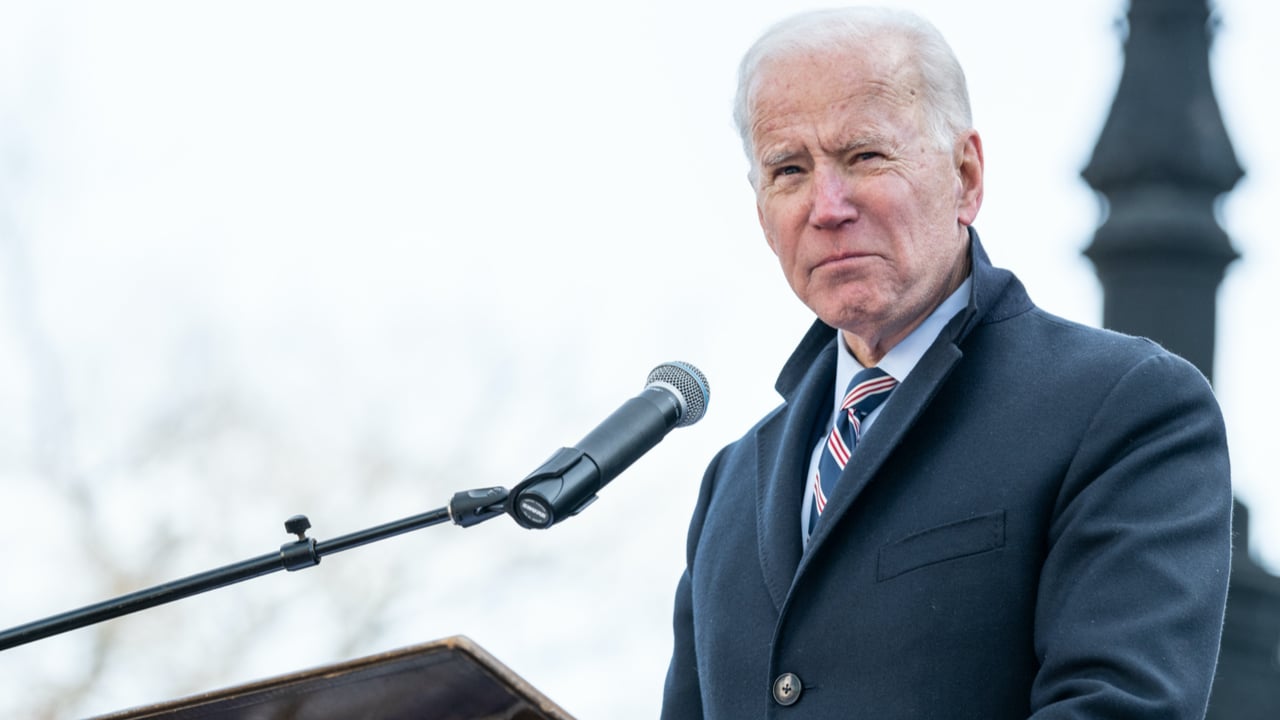

Joe Biden Claims Inflationary Pressure ‘Rests With the Federal Reserve,’ Praises the Fed’s ‘Extraordinary Support’

On Wednesday, U.S. president Joe Biden explained that the country’s central bank was dealing with a large share of the inflationary pressures the American economy is dealing with today. Biden welcomes the possibility of tightening monetary easing and noted that he “respects the Fed’s independence.”

US President Joe Biden Says a ‘Critical Job in Making Sure Elevated Prices Don’t Become Entrenched Rests With the Federal Reserve’

Inflationary pressures have been building in the U.S. as consumers are paying far more for goods and services in 2022, and last year’s prices continued to grow worse. American consumers are paying more for housing, rentals, food, raw materials, lumber, and automobiles. Just recently, senator Rand Paul, R-Ky., published a report that said inflation or the “hidden tax” was “only going to get worse.” Furthermore, reports published on Thursday note that U.S. jobless claims have risen significantly to a three-month high.

While inflation rose to 7% last month compared to 2020, over 6% for three months in a row prior, and while retail sales slipped significantly in December 2021, U.S. president Joe Biden thinks most of the pressure is on the American central bank. Speaking at a news conference on Wednesday, Biden said that Americans “faced some of the biggest challenges that we’ve ever faced in this country these past few years.”

“But we’re getting through it,” Biden added. “And not only are we getting through it — we’re laying the foundation for a future where America wins the 21st century by creating jobs at a record pace, and we need to get inflation under control.” The U.S. president then declared that the coronavirus was to blame for much of the country’s economic issues.

“Covid-19 has created a lot of economic complications, including rapid price increases across the world economy. People see it at the gas pump, the groceries stores, and elsewhere,” Biden stressed. While Americans are seeing the problem first hand, Biden remarked that lots of pressure falls on the U.S. Federal Reserve.

“A critical job in making sure elevated prices don’t become entrenched rests with the Federal Reserve, which has a dual mandate: employment and stable prices,” Biden noted during the press conference.

The American president continued:

The Federal Reserve provided extraordinary support during the crisis for the previous year and a half. Given the strength of our economy and pace of recent price increases, it’s appropriate — as Fed Chairman Powell has indicated — to recalibrate the support that is now necessary. I respect the Fed’s independence.

Peter Schiff: ‘POTUS Failed to Level With the American People About Inflation,’ Americans Disagree Most of the Inflation Burden Falls on the US Central Bank

Following the message from the president of the United States (POTUS), the economist and gold bug Peter Schiff called out Biden for failing to be honest with Americans about inflation.

“Today, POTUS failed to level with the American people about inflation,” Schiff tweeted. “It’s a tax that pays for government spending. If people want less inflation, then the government has to spend less so the Fed can print less. If Americans want [Build Back Better] they’ll pay for it with higher inflation.”

Furthermore, many Americans disagree that most of the burden falls on the U.S. central bank as U.S. citizens and businesses are struggling with the loss of purchasing power. “One of my best friends owns a handful of restaurants,” the author of the Dialed in Men blog, Ryan Stephens tweeted on Wednesday. “The last 18 months have been hell. All paper products = 55% increase over the last 18 months,” Stephens added.

Stephens continued to highlight that a case of bacon before the pandemic was $75, and it is now $187. A case of chicken was $35 pre-pandemic and today it is $90, while fry oil was $20 for a 35lb lug, today it’s $43.

What do you think about the rising inflation in the U.S. and Joe Biden’s comments about the Federal Reserve handling the issue? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment