Gold bug Peter Schiff has claimed that though bitcoin went up by 60% during the past twelve months, most of these gains were achieved during the first five weeks of the year in 2021. He insists that the majority of those that bought the asset in 2021 have not gained.

Bitcoin Gains Higher Than Those of Gold

With the calendar year ending and bitcoin up more than 60% since last January, one of the crypto asset’s chief critics, Peter Schiff, has claimed in a tweet that this gain was only achieved in the first five weeks of 2021. Schiff argues that the majority of people who bought the digital asset in 2021 have not gained.

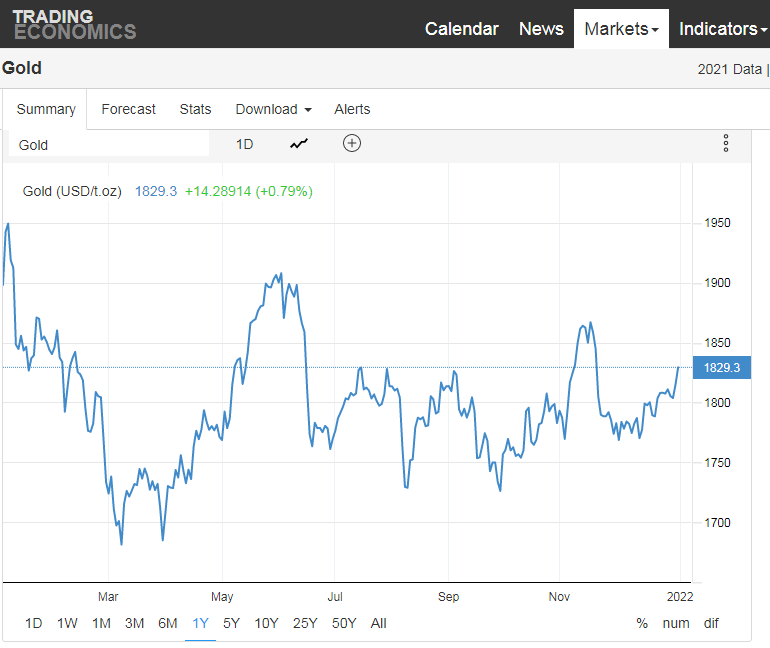

Indeed, after starting 2021 trading at just above $29,300, the price of bitcoin — as shown by Bitcoin.com data — more than doubled and was trading just above $63,500 by mid-April. This is in contrast to Schiff’s gold which started the year trading at around $1,900 per ounce but had dropped to $1,730 at around the same time.

While prices of both assets continued to fluctuate throughout 2021, year-end data shows that the crypto asset had again outperformed gold after it recorded double-digit gains once more. This performance suggests that despite it being a very volatile asset, it still generated positive returns for investors, even after February.

Gold, on the other hand, ended the year nearly 4% lower, a fact Schiff does not mention in one of his last anti-bitcoin tweets of 2021. Instead, he uses the crypto asset’s price in February 2021 to support his argument that bitcoin has not generated positive returns for a majority of investors. Schiff said:

Bitcoin bulls point to bitcoin’s 60% gain in 2021 as more evidence that it’s the best asset to buy. But all of those gains occurred during the first five weeks of the year. Bitcoin is lower now than it was in Feb. The vast majority of people who bought Bitcoin in 2021 are down.

Five-Digit Gains

Besides bitcoin, which ended the year 60% higher than it started, numerous other cryptocurrencies also outperformed gold. Ethereum, which hit an all-time high of $4,891 in November, had a net gain that surpassed 500% by the end of 2021.

Also, a Bitcoin.News report shows that about ten crypto assets had gains of more than 10,000% during the same period.

Schiff’s tweet has riled bitcoin proponents. For instance, in their response to the gold bug’s latest attack on BTC, one Twitter user named Moon Landing asked why Schiff worries too much about bitcoin. Another user, Benjamin Cowen suggested that gold no longer keeps up with inflation. He tweeted:

“The vast majority of people who bought gold over the last decade have just watched it not even keep pace with inflation.”

Do you agree with Peter Schiff’s latest claims? Tell us what you think in the comments section below.

Comments

Post a Comment