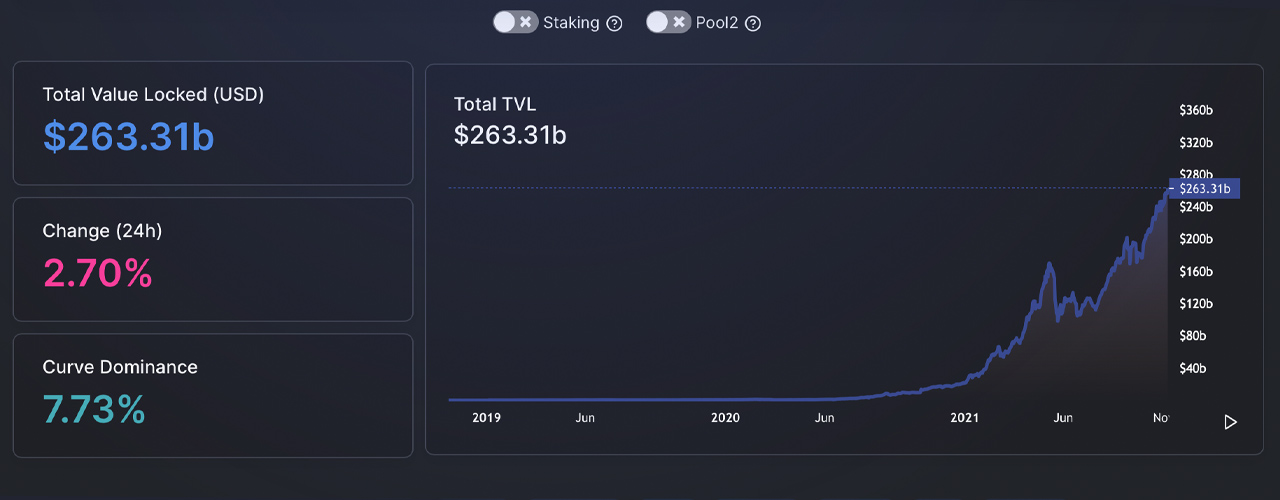

Decentralized finance (defi) protocols continue to shine as the total value locked in defi is over $260 billion. While Ethereum started the defi trend and holds the lion’s share of TVL in defi, a great number of decentralized applications (dapps) are supporting a slew of alternative blockchains.

Today’s Most Popular Dapps Support More Than One Network

On November 7, the total value locked in defi is $260 billion according to defillama statistics on Sunday. When defi first started making waves, most of the dapps that people interacted with leveraged the Ethereum (ETH) blockchain. Toward the end of 2021, all that has changed as cross-chain technology is hotter than ever and dapps are now supporting a myriad of networks.

For instance, Curve, the automated market maker (AMM) protocol, holds the largest percentage of TVL with its $20.08 billion commanding 7.71%. Curve also connects with seven different blockchain networks with Ethereum included. Chains include Avalanche, Harmony, Polygon, Arbitrum, Fantom, Xdai, and Ethereum.

Another large dapp with $15.75 billion TVL is Aave, the decentralized lending system and users from three different blockchains (ETH, AVAX, MATIC) can access the dapp. When it comes to cross-chain support the dapp Sushiswap has a significant number of chains as 12 blockchain networks can access the dapp. Chains like Palm, Xdai, Polygon, Avalanche, Celo, Okexchain, Moonriver, Harmony, Binance Smart Chain, Heco, Ethereum, and Arbitrum.

Sushiswap, Anyswap Support 12 Different Chains — Cross-Chain Support Trend Continues to Swell

With all those connections, the decentralized exchange (dex) platform Sushiswap has a TVL of $6.8 billion. The Anyswap dapp also supports 12 different networks and the only difference between it and Sushiswap is that the dapp supports the Kucoinchain. Other popular dapps that leverage more than one network include protocols like Abracadabra, Balancer, Uniswap V3, Renvm, Cream Finance, Synthetix, Mirror, Beefy Finance, Badger DAO, and Alpha Finance.

Of course, all of these applications also support Ethereum, but as ether gas fees have risen dramatically this year, competitors have started to catch up. During the last nine months, a great deal of dapps have been adding support for alternative blockchains and it doesn’t seem like this trend will stop growing any time soon.

What do you think about the defi applications that now serve various blockchains? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment