Bitcoin’s Hashrate Soars 42% Higher Over the Last 3 Months Following Crypto Asset’s 36% Price Increase

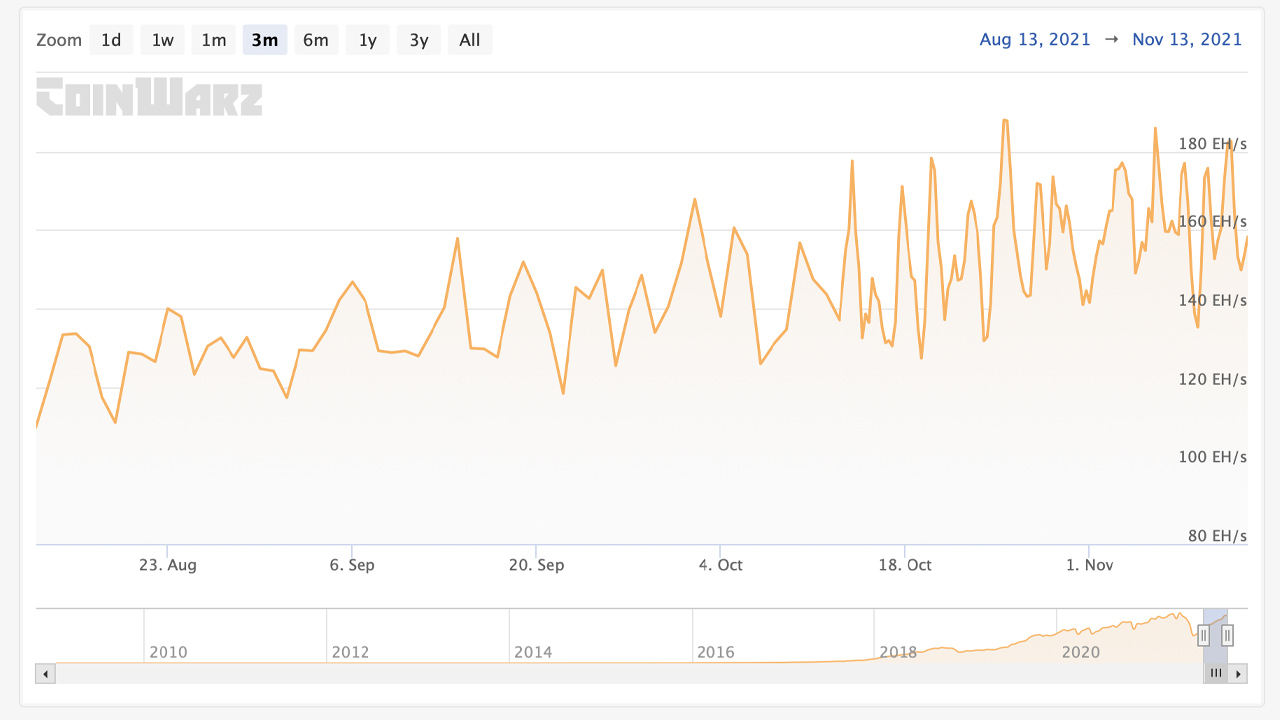

While bitcoin has been hovering above the $60K handle for a great majority of the last 28 days, the network’s hashrate has jumped considerably during that time as well. Since August 13, Bitcoin’s hashrate has climbed 42% from 110 exahash per second (EH/s) to today’s 157 EH/s. Moreover, after nine consecutive difficulty changes, going forward, it will be 50% more difficult to mine bitcoin than it was three months ago for the next two weeks.

Bitcoin’s Hashrate Follows the Price Rise

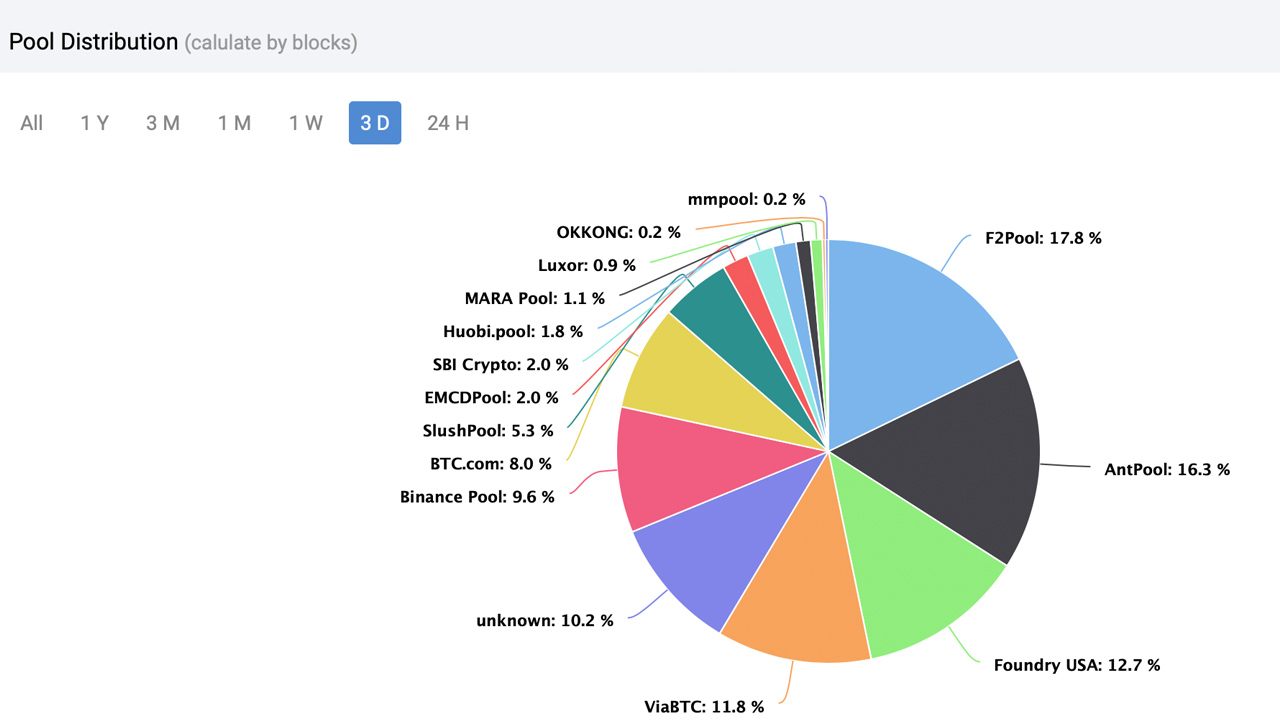

At the time of writing, Bitcoin’s hashrate is coasting along at 157 EH/s and approximately 14 known mining pools are dedicating hashpower to the network. 16.39 exahash or 10.24% of the network is being mined by stealth miners and the hashrate is classified as “unknown.”

The unknown hashrate represents the fifth-largest mining ‘pool’ dedicating hash toward the network. Meanwhile, during the last three months, Bitcoin’s hashrate has followed the price moving northbound. The overall hashrate is 42% higher than it was three months ago and that was roughly a month after China’s crackdown on bitcoin miners.

Bitcoin Is 50% More Difficult to Mine Than It Was 3 Months Ago

In the last three months, hashrate averages show that at some points during the last three months, Bitcoin’s hashrate ran as high as 180 EH/s. Bitcoin’s hashrate has climbed above the 180 EH/s region three times since October 25.

Bitcoin’s price has hovered above the $60K price range since October 15 and dipped under $60K on one occasion during that time. Because the hashrate has been gradually rising, Bitcoin’s network difficulty as of this weekend, will have adjusted upward nine times in a row. The nine adjustments equates to being over 50% more difficult to mine bitcoin (BTC) since July 17, 2021.

4 Pools Command 58% of Network’s Processing Power

Today, the top four mining pools command 58.6% of the network’s hashrate during the last three days. F2pool is the largest mining pool with 28.51% EH/s and Antpool commands 26%. Foundry USA captures 12.69% of the global hashrate as the third-largest mining pool today. Foundry’s pool commands roughly 20.32 EH/s at the time of writing.

Viabtc is the fifth largest mining pool with 11.8% of the global hashrate translating to 18.89 EH/s. The fifth-largest hashrate today belongs to stealth miners known as “unknown” with 16.39 EH/s. Below this portion of the hashrate pie is another ten mining pools dedicating hashrate to the BTC chain.

Market’s Most Profitable Miners Are Raking in $34 to $45 per Day

The most profitable miners on the market are making decent profits between $34 to close to $45 per day with today’s exchange rates, the current mining difficulty, and $0.07 per kilowatt-hour (kWh) in electricity costs. The Microbt Whatsminer M30S++ (112 TH/s) will bring in 44.77 per day at current BTC exchange rates and the Bitmain Antminer S19 Pro (110 TH/s) pulls in $44.24 per day.

Canaan’s top model, the Avalonminer 1246 (90 TH/s) can get around $34.92 every 24 hours using current exchange rates. If the new Bitmain Antminer S19 XP was in the wild today, it could pull in around $58.20 a day with its 140 TH/s hashpower. However, the unit is not expected to be sold until July 2022.

What do you think about the recent mining action and Bitcoin’s hashrate climbing 42% higher in three months? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment