SEC Tweets About Funds Holding Bitcoin Futures — Expectations of Impending Bitcoin ETF Approval Soar

The U.S. Securities and Exchange Commission (SEC) has tweeted about investing in funds that hold bitcoin futures contracts. This has sparked optimism within the crypto community that the regulator may soon approve bitcoin exchange-traded funds (ETFs), especially those investing in bitcoin futures.

Optimism Grows That SEC Will Approve a Bitcoin Futures ETF Soon

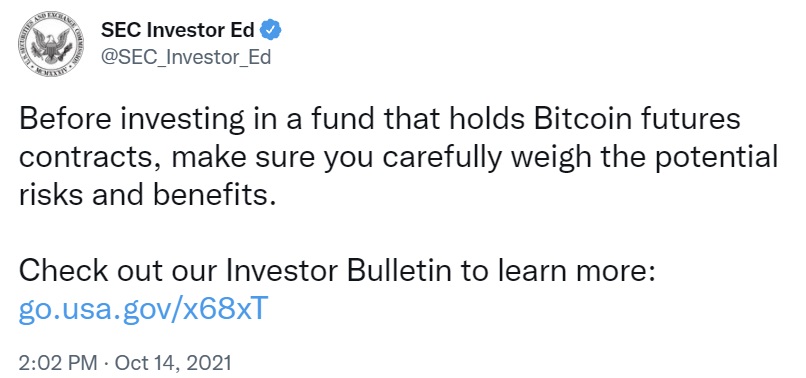

The official Twitter account for the SEC’s Office of Investor Education and Advocacy tweeted Thursday: “Before investing in a fund that holds bitcoin futures contracts, make sure you carefully weigh the potential risks and benefits.”

The tweet references an investor bulletin jointly published in June by the SEC’s Office of Investor Education and Advocacy and the Commodity Futures Trading Commission’s (CFTC’s) Office of Customer Education and Outreach. The bulletin urges “investors considering a fund with exposure to the bitcoin futures market to weigh carefully the potential risks and benefits of the investment.”

Comments flooded Twitter from people speculating that the SEC will soon approve a bitcoin futures ETF. Many people simply exclaimed, “bullish.”

One Twitter user wrote, “They probably wouldn’t post this if it wasn’t going to get approved.” Another commented, “Posting this would indicate with great likelihood a BTC ETF is coming, possibly next week.” A third person said, “This is a clear indication of what is to come very very soon.” As Bitcoin.com News reported, the SEC could approve several bitcoin strategy ETFs this month.

Bloomberg’s senior ETF analyst, Eric Balchunas, opined:

Getting closer: The SEC just tweeted out an edu bulletin they wrote back in June re bitcoin futures and ‘funds that hold bitcoin futures.’ Clearly good sign and we [are] upping our odds to 85%.

Balchunas mentioned another sign that a bitcoin ETF approval may be imminent. “Valkyrie just updated their bitcoin futures ETF prospectus (which typically only happens when ducks in row ready for launch). They added their ticker $BTF, altho no fee still. Can’t say this is done deal type evidence but a good sign IMO,” he tweeted Wednesday.

However, since the investor bulletin was published in June and the SEC tweeted a similar message about investing in funds holding bitcoin futures back then, some people cautioned that Thursday’s tweet does not indicate a bitcoin ETF approval.

Economist and trader Alex Kruger noted: “Market interpreting this SEC post as odds of bitcoin futures ETF increased dramatically but note the SEC had posted the same thing back in June.”

Balchunas further detailed that the last time the SEC tweeted this bulletin was on July 26, one day before the Profunds’ bitcoin strategy mutual fund “went effective” and two days before it launched. He concluded that if the pattern holds, “Proshares ETF will be trading Mon or Tue (which was our prediction all along).”

The crypto community is hopeful that the SEC will approve bitcoin futures ETFs since SEC Chairman Gary Gensler repeatedly indicated that he is open to this type of investment. He also said that he looked forward to the staff’s review of bitcoin futures ETF filings.

Do you think the SEC will approve a bitcoin ETF this year? Let us know in the comments section below.

Comments

Post a Comment