Recent metrics from a variety of analytical web portals show that the quantity of bitcoin whales has been shrinking in recent times. The data indicates that the leading crypto asset has been distributed quite a bit since the price run-up started.

Pods of Bitcoin Whales Shrink — Addresses With Small Quantities of Bitcoin Catch the Downward Distribution Cycle

Today, data shows that bitcoin whales are shrinking and metrics from bitinfocharts.com’s top 100 richest bitcoin addresses list compared to a whale count article Bitcoin.com News published on May 14, show things have changed. Statistics from Glassnode show that whale-sized addresses with 1,000 BTC+ have dipped to the smallest amount in eight years and ten months ago.

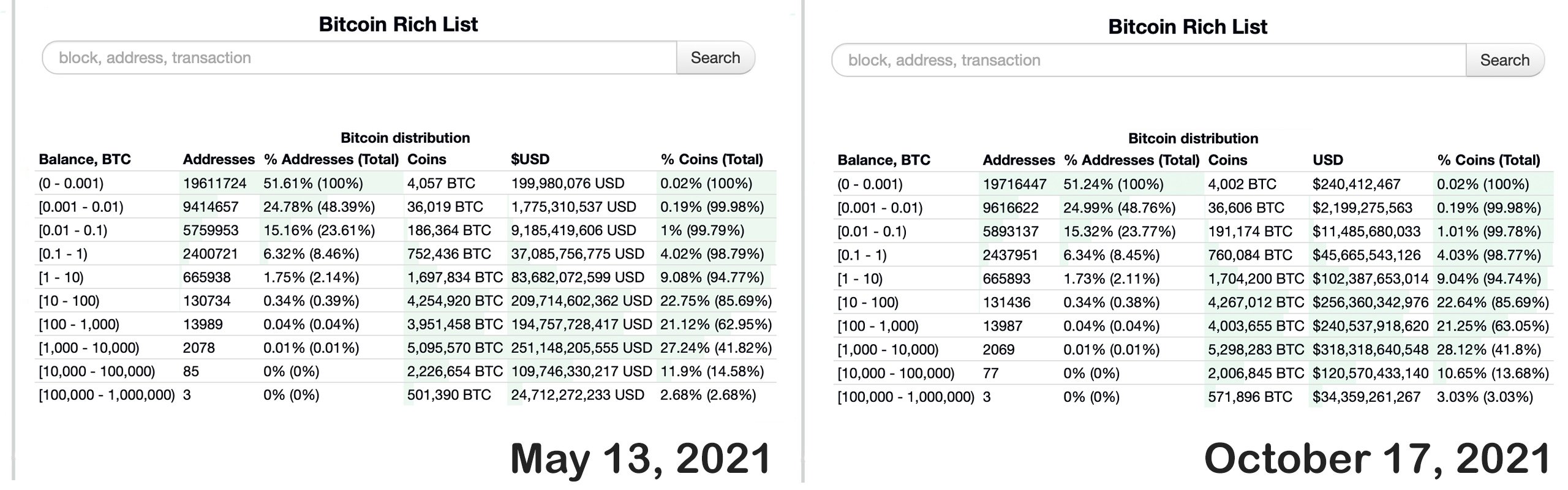

In addition to those two sites that offer onchain whale analytics, whalemap.io also implies a decline in whales (balance ≥ 1k) and a downward distribution cycle. Also, the top 100 richest bitcoin addresses from bitinfocharts.com indicate that on May 13, 2021, there were three whales with 100,000 to 1 million BTC.

There are still just three today, and that number hasn’t changed in quite some time. In terms of addresses holding 10,000 to 100,000 bitcoin, that has reduced since May 13, from 85 to 77 addresses. As far as holders with 1,000 to 10,000 bitcoin, there were approximately 2,078 addresses five months ago and today the count is 2,069.

Trickle-Down Distribution — Bitcoin Whales Offloaded Coins During the 2012 Bull Run

Additionally, addresses with 100 to 1,000 BTC were around 13,989 five months ago and today are 13,987. The bottom threshold of addresses holding 10 to 100 BTC or less has increased a great deal during the last five months.

In recent weeks, all the BTC addresses with less than 1,000 held have swelled. 51.24% of addresses recorded own between 0 to 0.001 BTC, which is 19,716,447 bitcoin addresses. Addresses that hold 0.1 to 1 BTC today equal around 2,437,951 bitcoin addresses and there are 665,893 holders with at least 1 to 10 BTC.

February – May $BTC whales (>1k BTC) were gradually selling to retail investors (>.1 BTC). This is why the distribution phase displayed on the HT chart. They kept the price stable via manipulation until they were finished selling – then collapse. The whales won, again. #Bitcoin pic.twitter.com/ia8C8ze99h

— Illusive ⛓ (@IllusiveTrades) October 10, 2021

It’s quite possible that while bitcoin (BTC) rose over 25% during the last 30 days, a number of bitcoin whales took some cream off the top by selling. It’s also probable that whales have simply dispersed their bitcoin wealth into more addresses.

The last time BTC whale addresses were this low was the holiday season in 2012 and that followed bitcoin’s first bull run. In the summer of 2012 and into the fall months, BTC tapped a high of $30 per unit, but in December 2012, it was just over $2 per coin. Whale count saw a major downward distribution cycle at that time as well. A whale with 1,000 bitcoin on Sunday evening is worth roughly $62 million.

What do you think about the whale count shrinking? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment