A crypto survey of U.S. consumers, commissioned by regulated crypto platform Bakkt, shows that nearly half of all respondents said they invested in cryptocurrencies during the first half of the year.

Nearly Half of US Consumers Invested in Crypto During the Past 6 Months, Study Shows

A survey commissioned by regulated digital asset platform Bakkt shows that nearly half of surveyed consumers in the U.S. invested in cryptocurrencies in the past six months this year. Bakkt was launched in 2018 by Intercontinental Exchange, which operates over a dozen of the world’s most prominent exchanges including the New York Stock Exchange (NYSE).

“Commissioned by Bakkt and conducted over an online survey tool, we polled more than 2,000 consumers across the U.S. and was fielded in July 2021 … Data have been weighted for age, race, sex, education, and geography using the Census Bureau’s American Community Survey to reflect the demographic composition of the United States,” the survey report explains. According to the results released Wednesday:

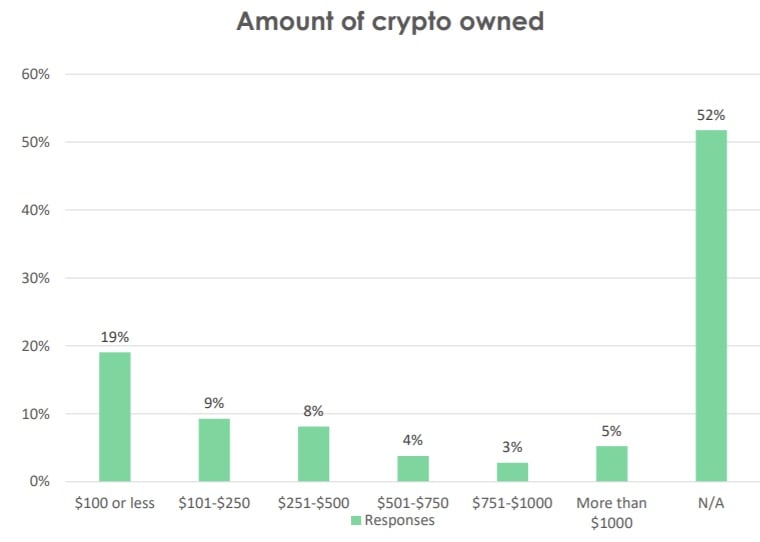

Nearly half (48%) of U.S. consumers reported investing money in cryptocurrency during the first half of the year.

“Of those who haven’t invested in cryptocurrency, 32% of respondents are interested in buying cryptocurrency in the next six months,” the report notes.

The survey also found that among those who have already purchased cryptocurrencies, “58% view it as a long-term investment, while 43% admit that they plan to sell when they can make a short-term profit.” In addition, 24% revealed that they plan to use cryptocurrency for online purchases and 12% said they plan to use it for in-person purchases.

Furthermore, “The most appealing attribute of cryptocurrency for the full sample is ‘long-term return on investment’ (28%), with all other attributes – lack of fees, ease of access, FOMO, and lack of centralized control closely following.”

Meanwhile, the study reveals that “Nearly 40% of respondents did not realize that they could buy part of a cryptocurrency (i.e. not the whole price of a coin).”

Noting that “Digital assets are driving a new, increasingly dynamic economy,” Bakkt CEO Gavin Michael commented:

The results of the survey demonstrate that Gen Z and millennials are adopting crypto en masse and for alternative forms of payment, but the biggest roadblock standing in their way has been lack of understanding on how to get started and concerns with market volatility.

What do you think about this U.S. consumer survey on cryptocurrency? Let us know in the comments section below.

Comments

Post a Comment