In the early days, there were only a few web portals with cryptocurrency statistics and data tied to these ever-changing digital asset markets and blockchain metrics. More than ten years later, however, data and analytics tethered to the world’s most popular and most used digital currencies have swelled with growth. The following article delves into a myriad of web portals that offer insights into the innovative land of cryptocurrencies.

Charts, Onchain Metrics, and Coin Market Cap Aggregation

Over a decade ago, there were a couple of websites that shared information concerning bitcoin (BTC) and the small number of digital assets that traded beside BTC in the early days. A few websites displayed BTC’s price and a handful of onchain statistics, so people could get a sense of crypto markets and the utility of these blockchains. Web portals in the early days consisted of price chart pages like zeroblock.com, onchain metrics from blockchain.info (now blockchain.com), and crypto coin market aggregators like coinmarketcap.com.

Now with more than 10,000 crypto assets worth around $2.21 trillion on September 12, 2021, there’s a plethora of data and analytical websites that help guide crypto supporters with various forms of insight. Coinmarketcap.com has a number of competitors now such as coingecko.com, coincap.io, markets.bitcoin.com, and messari.io. All of them are very different and they each give a contrasting perspective on crypto coin market cap aggregation, alongside insights into different kinds of market data. Coingecko.com and messari.io, for instance, show metrics like percentages for crypto coins over 24 hours, one week, two weeks, 30 days, 90 days, and year-to-date.

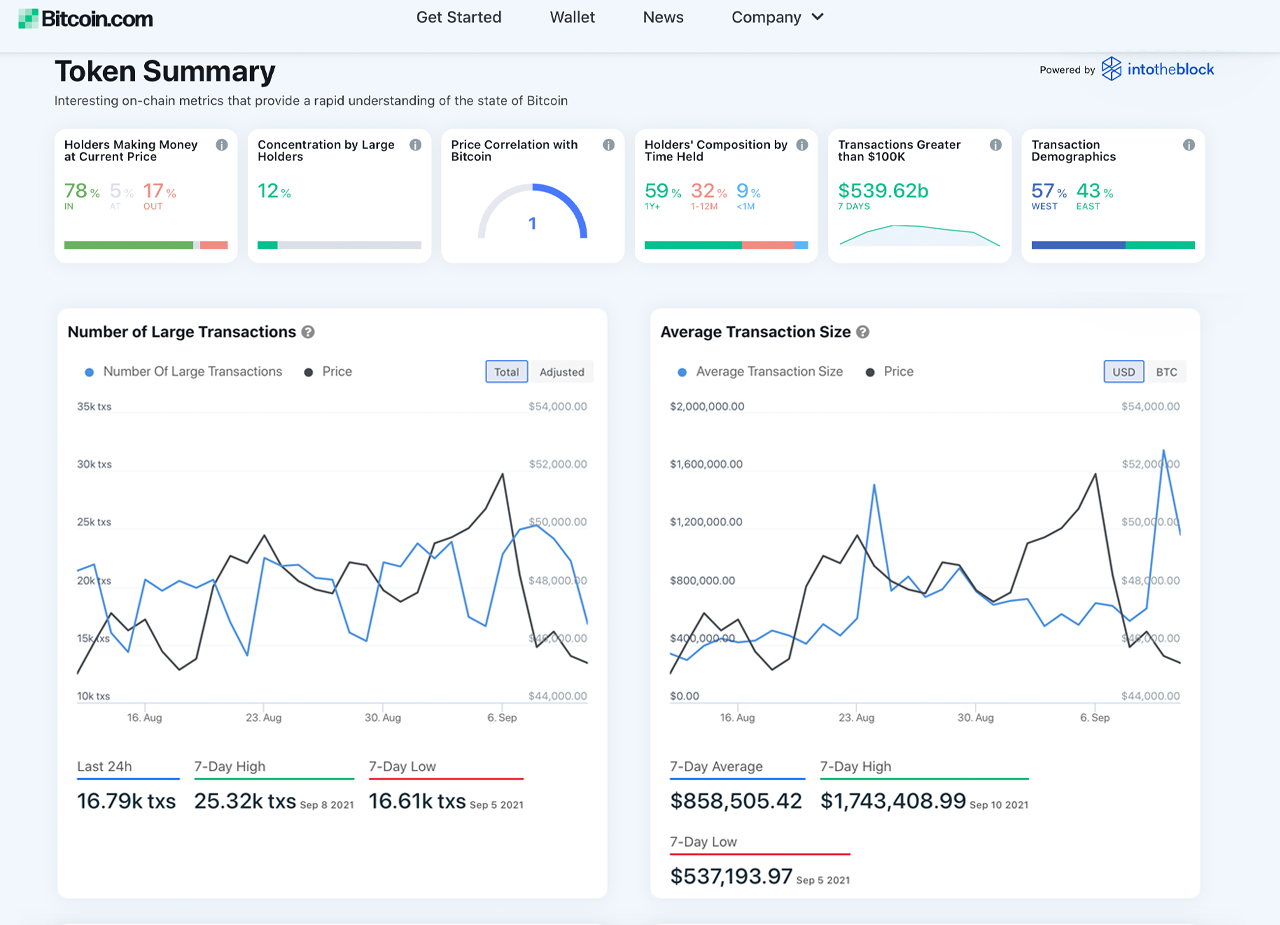

Markets.bitcoin.com offers a unique perspective of coin market caps and individual insights to different coins with professional tradingview.com charts. Furthermore, the cryptocurrency market aggregator from Bitcoin.com also shows token summaries stemming from intotheblock.com. The portal coincap.io is similar to markets.bitcoin.com and coingecko.com, as it shows an aggregated list of cryptocurrencies by market capitalization. Coincap.io is also interesting because visitors can swap tokens by connecting a decentralized finance (defi) wallet like Metamask, Portis, Torus, and the Coinbase Wallet.

Track, Compare, Access Important Ecosystem Platforms

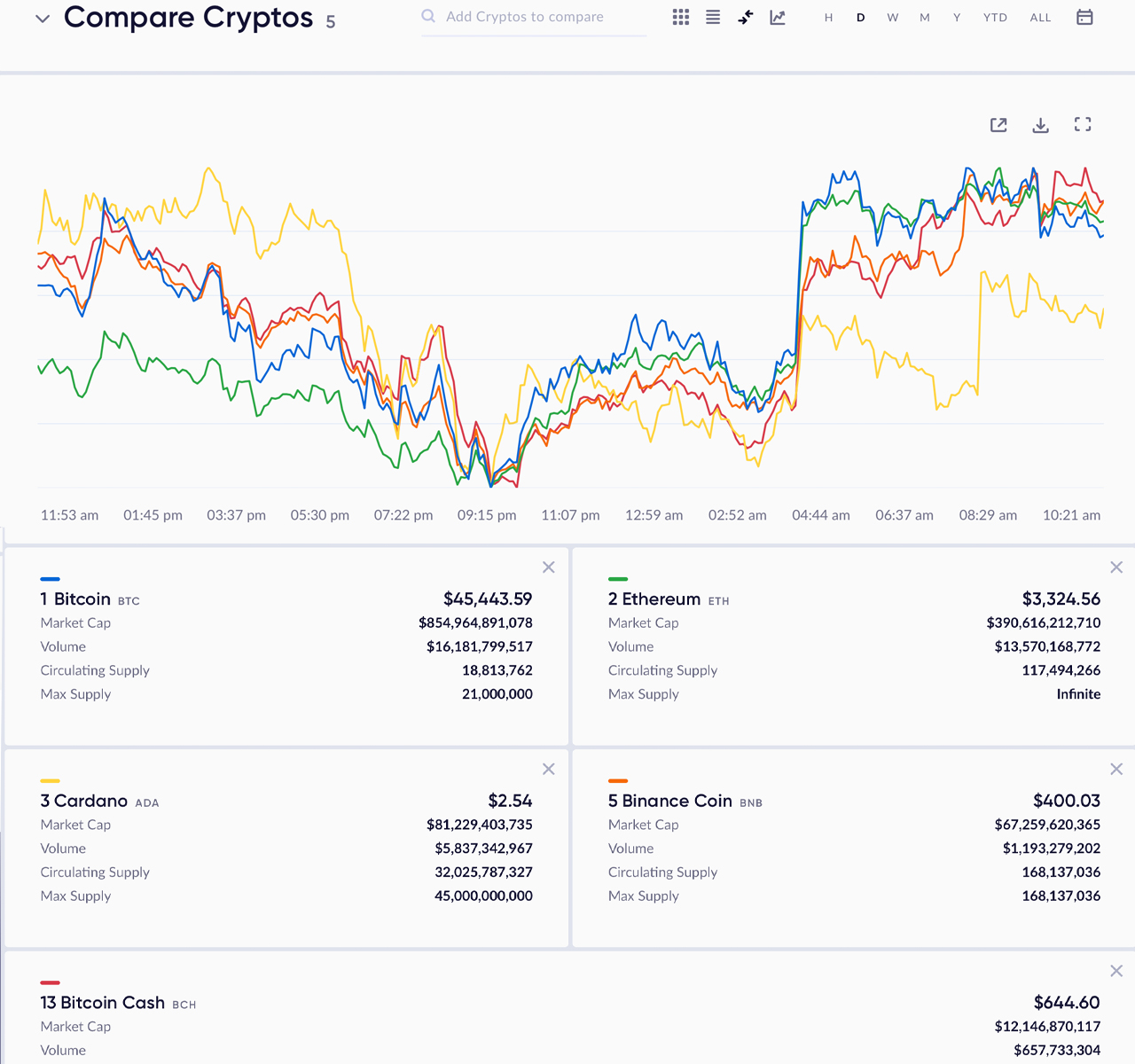

Another website that helps users explore cryptocurrency markets is coinread.com, which offers insight into 1,752 cryptocurrencies and metrics from more than 100 crypto exchanges. Coinread.com provides a few distinct methods to look at key metrics like rank, volume, circulating supplies, and the top exchanges where these digital currencies are traded the most. Users can compare different crypto assets to view price movements in a chart showing a myriad of choices.

Further, coinread.com users can track different coins and follow the market changes tied to the user’s portfolio. Individual crypto assets are broken down into different time intervals, like one hour, 24 hours, seven-day, one month, and annual changes. Users can view an individual crypto asset to get a description of the token, alongside important information like the project’s website, white paper, source code, blockchain explorers, social media links, and forums.

All of these web portals offer different perspectives when it comes to the vast land of crypto assets and there are many more helpful websites to keep you informed. Defillama.com, for instance, is a defi dashboard that shows the aggregate total value locked in defi applications across multiple blockchains. Users can get further insights on crypto derivatives markets like options, futures, and perpetual swaps from the web portals skew.com and bit.com as well.

Dune Analytics offers insights to onchain Ethereum data, ether-based products and market statistics tied to things like defi, non-fungible tokens (NFTs), and decentralized exchange (dex) platforms. Dappradar.com also shows a plethora of factoids and market stats tethered to defi, NFTs, and NFT markets.

The aforementioned list of web portals that inform crypto investors barely scratches the surface when it comes to data sites and analytical products. The best part, however, is that all of these crypto applications are free to use even though some of the sites offer more tracking depth for paid subscribers.

What do you think about the web portals that offer crypto supporters insight into the growing world of cryptocurrencies, markets, and onchain statistics? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment