Seven days ago, non-fungible token (NFT) marketplaces saw sales nosedive after reaching all-time highs during the month of August. A week later sales have rebounded to a degree and NFT marketplaces like Opensea, Rarible, and Superrare have seen improvements in terms of seven-day trade volumes.

Opensea, Rarible, Hic et nunc, Makersplace, Superrare See NFT Weekly Volumes Improve

On September 12, 2021, Bitcoin.com News reported on the fact that non-fungible token (NFT) sales had plummeted 86% on September 10 from a mid-August all-time sales high. The report noted that the top NFT marketplace by sales volume, Opensea, saw its seven-day sales slide 52.47%. A variety of NFT markets and popular collections had seen sales slow down dramatically between September 10th to the 13th.

However, a week later, NFT sales are rebounding to some degree and popular markets and collections are picking up steam. Statistics from dappradar.com indicate that Opensea saw $629.35 million in trade volume across 172,267 traders.

Weekly volume has improved by 0.94% and the number of Opensea traders has jumped by 9.02%. Opensea is compatible with the Ethereum and Polygon networks. The second-largest NFT project by weekly volume on September 19 is Axie Infinity with $110.61 million in seven-day sales.

Despite being the second-largest in terms of seven-day volume, Axie Infinity volume is ultimately down 23.93% during the last week. Rarible’s volume during the week was $4.9 million and it’s up 60.27% higher than last week.

The Tezos-powered Hic et nunc NFT marketplace raked in $4.51 million and is up 35.69% this week. The marketplace Superrare.co took in $3.31 million and increased 11.92% in seven days. Makersplace did well this week raking in about $557K in trade volumes and an increase of 31.83%.

NBA Top Shot, Atomicmarket, Aavegotchi, Foundation NFT Volumes Slide — Old 2017 Rare Pepe Series 1 Card Enters Top Ten Sales

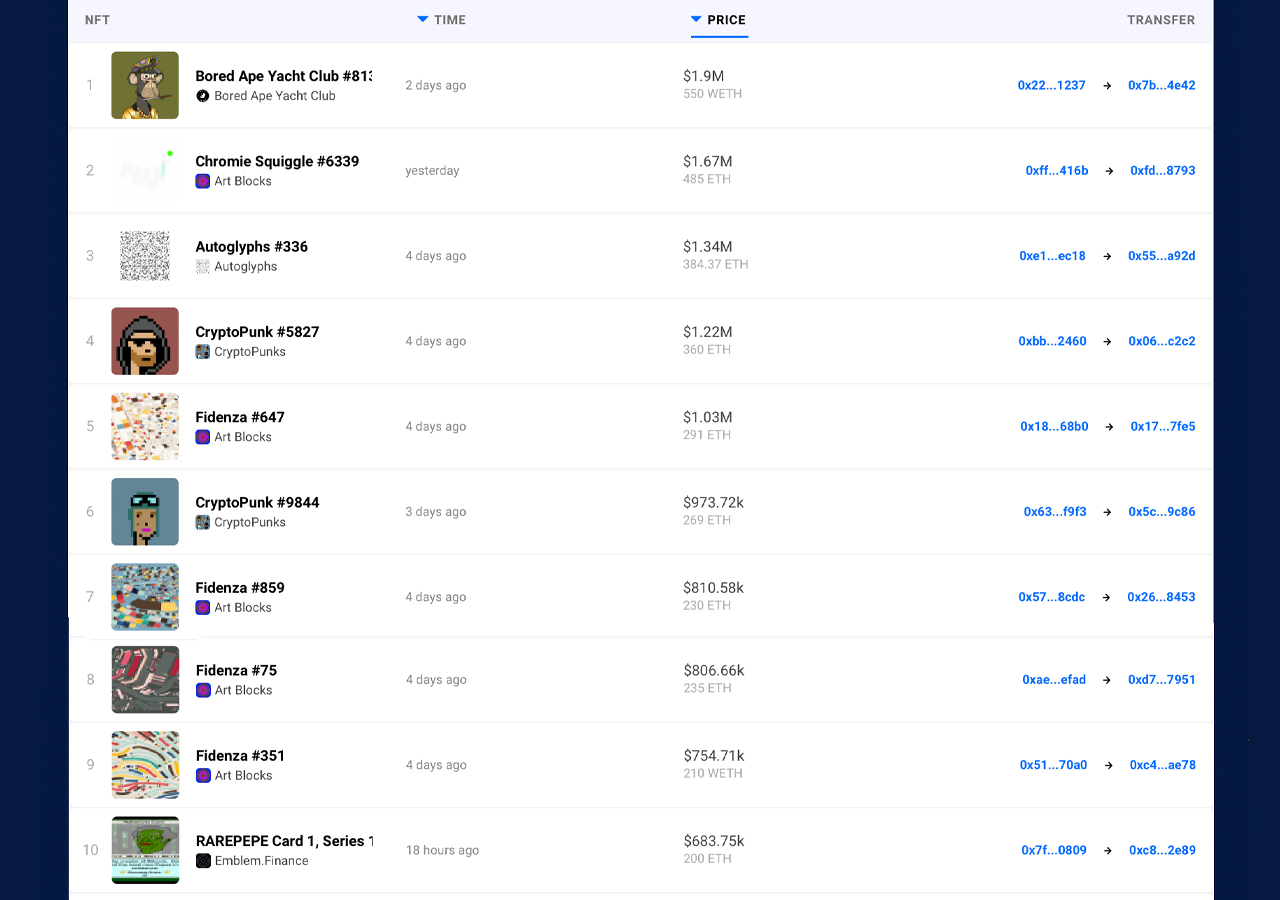

NBA Top Shot, Atomicmarket, Aavegotchi, and Foundation all saw losses in weekly trade volume as percentage losses range between 17.94% to 59.53%. The largest NFT sale this week stemmed from the Bored Ape Yacht Club (BAYC) collection, as BAYC #81 sold for $1.9 million this week.

A dominant force in this week’s top ten NFT sales includes NFTs stemming from the Artblocks collection. An older NFT, RAREPEPE Card 1, Series 1 sold for $683.75K or 200 ether 18 hours ago making it into the top ten NFT sales category this week.

Weekly stats from nonfungible.com’s market data indicates that last week’s NFT sales on September 11 were around 36,095 sales. This week there are now 46,390 NFT sales with an increase of around 28.52%. In terms of the number of unique wallets which bought or sold an NFT asset, nonfungible.com stats show 31,255 active market wallets.

What do you think about NFT trade volumes from different marketplaces rebounding from last week’s slump? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment