Of all funds sent to illicit cryptocurrency addresses from Eastern Europe, scams attract the greatest amount, according to a new report. In the past year alone, crypto addresses based in the region have sent the fraudulent schemes a staggering $815 million in crypto.

Eastern Europe Leads by Volume of Illicit Crypto Transactions

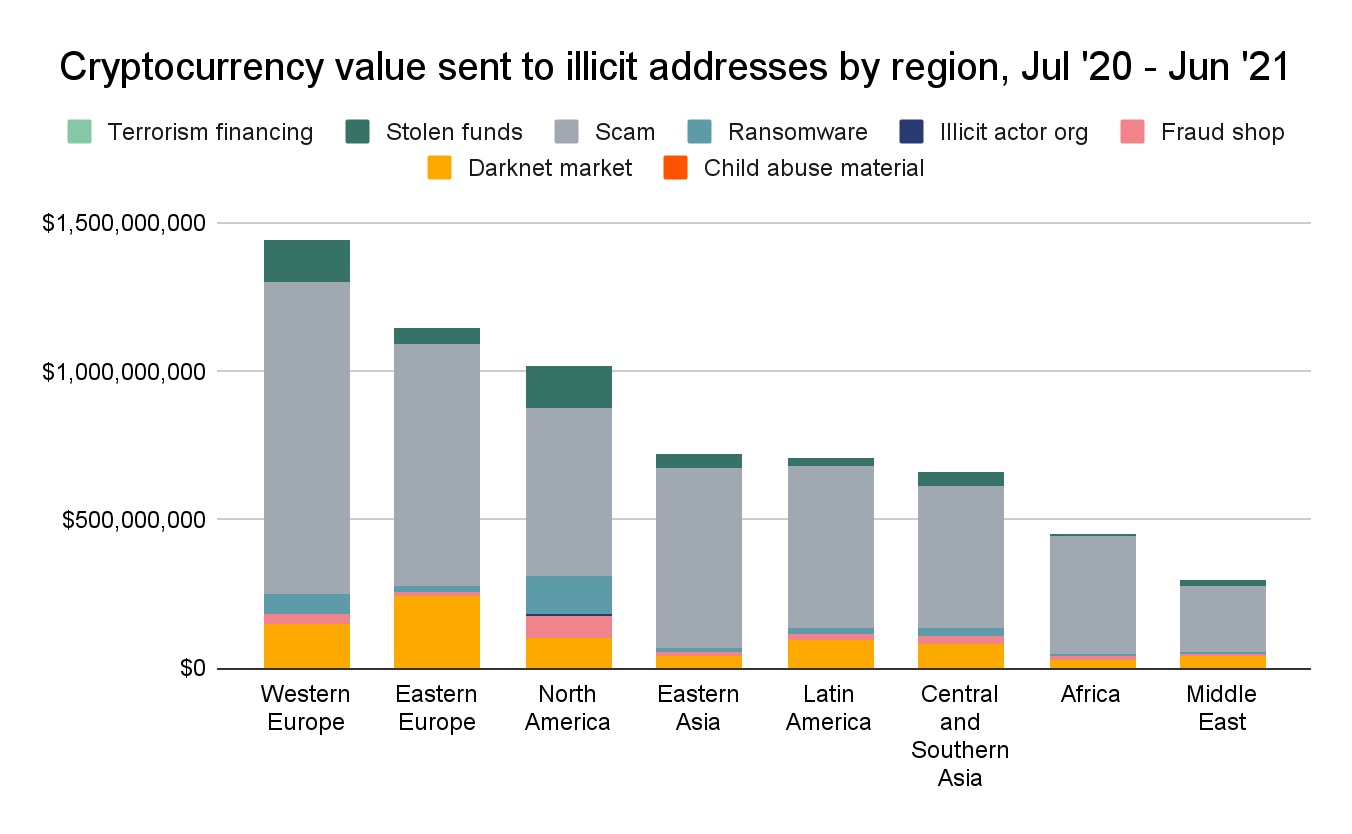

Among the world’s regions with a total crypto transaction volume of at least $400 million, Eastern Europe is the only one where illicit activity exceeds 0.5% of the total value sent and received, Chainalysis notes in a preview of its 2021 Geography of Cryptocurrency report. In a blog post published Wednesday, the blockchain forensics company revealed:

Between June 2020 and July 2021, Eastern Europe-based addresses sent $815 million to scams, second only to Western Europe.

Crypto addresses in East European countries have the second-highest rate of exposure to illicit addresses, with Africa topping the chart and Latin America ranking third, the excerpt details. However, Eastern Europe has a much larger overall cryptocurrency economy than either of the other regions in the top three.

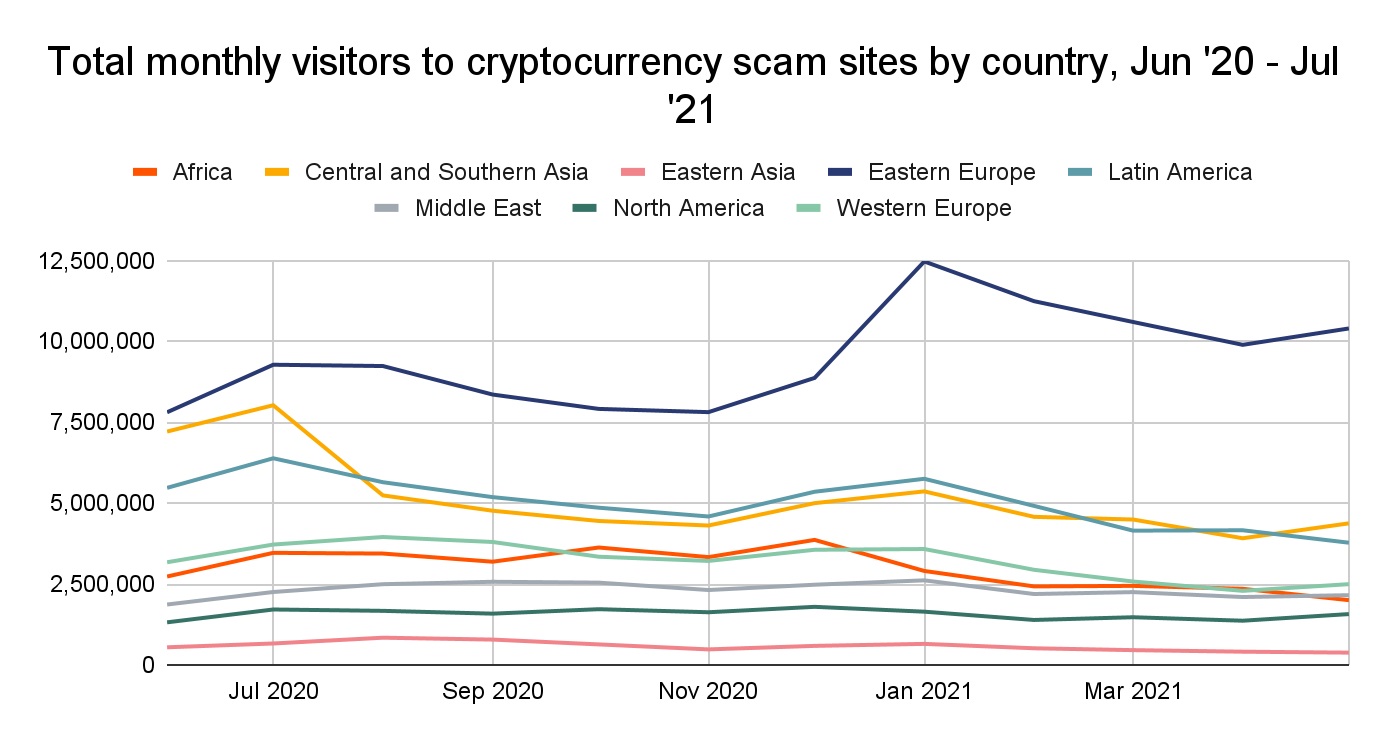

Researchers also remark that Eastern Europe accounts for the most web traffic to scam websites during the studied period. Among all nations, Ukraine is the marked leader with more than twice the number of web visits registered in the United States which is a distant second. The total number of monthly East European visitors to crypto scam sites peaked at 12.5 million in January.

While Eastern Europe sends more digital currency than other regions to darknet markets such as Hydra Market, which targets the Russian-speaking world, scams receive the largest share of East European crypto funds sent to illicit addresses, Chainalysis concludes. “We can assume that most of this activity represents victims sending money to scammers,” point out the authors of the report.

Finiko Ponzi Scheme Collects Over $1.5 Billion Worth of Bitcoin in 2 Years

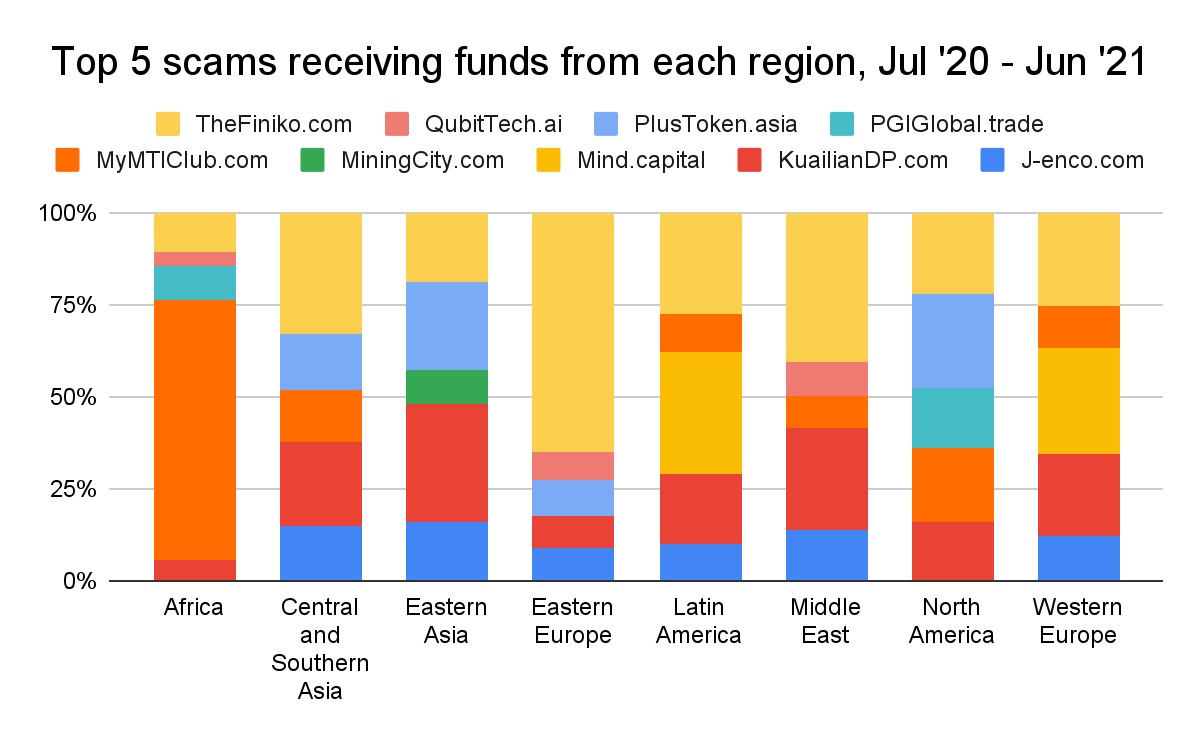

Chainalysis further notes that over half of the value sent to scam addresses from Eastern Europe went to one particular scam based in the Russian Federation — Finiko. The Ponzi scheme, which enticed crypto investors promising monthly returns of up to 30%, collapsed in July after receiving more than $1.5 billion worth of bitcoin (BTC) since December 2019, mostly from Russian and Ukrainian crypto holders.

According to Russian media, Finiko has been led by Kirill Doronin, an Instagram influencer also linked to other Ponzi schemes. With incomes falling amid economic difficulties worsened by the coronavirus pandemic, the scam targeted people who needed extra money. Many Russians fell for the financial pyramid scheme, just like in the “wild 1990s.”

Meanwhile, the officially estimated damages in the Finiko case have reached 250 million rubles (over $3.4 million), Forklog reported. The crypto news outlet quoted the latest version of the indictment against the pyramid’s founder in the Russian republic of Tatarstan. Independent experts claim the total losses exceed $4 billion. So far, 80 individuals have been recognized as victims of the scam, although the number of depositors is believed to be at least 850,000.

What are your thoughts on the findings in the Chainalysis report? Let us know in the comments section below.

Comments

Post a Comment