$2 Billion Worth of Unpeeled Casascius Physical Bitcoins: There’s Less Than 20,000 Coins Left Active

While bitcoin continues to become more scarce every day, the most popular set of physical bitcoins, crafted by Mike Caldwell from 2011 to 2013, have become far scarcer than their digital counterparts. As of September 18, 2021, there are now less than 20,000 active bitcoins from the Casascius physical bitcoin collection.

Casascius Physical Bitcoin Collection Grows Scarcer

Bitcoin has become a well-known technology and in the early years a number of people and companies deployed concepts called “physical bitcoins.” Essentially, a group or individual would fabricate a coin with the bitcoin symbol etched on it and the coin would also hold digital BTC hidden within the coin’s body.

It’s safe to say that the Casascius physical bitcoin collection created by Mike Caldwell is the most popular collection to date, and these rare physical bitcoins are sold for much more than the face value of the digital bitcoin they hold.

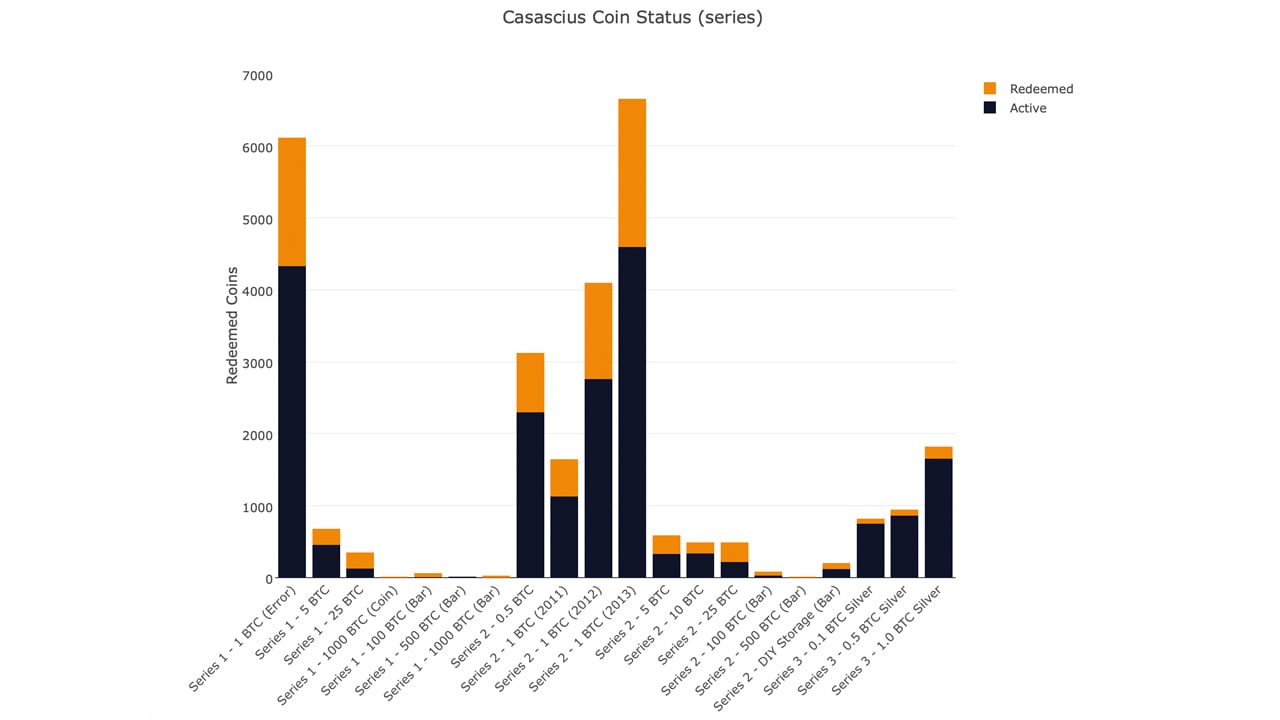

Casascius bitcoins sport a holographic tamper-resistant sticker on one side of the coin, and if the sticker is peeled, the digital bitcoin’s private key is revealed. Caldwell crafted both coins and bars that held loaded bitcoin (BTC) and created series 1 (1-1,000 BTC), series 2 (0.5-500 BTC + the DIY Storage Bars), and series 3 (0.5-1 BTC).

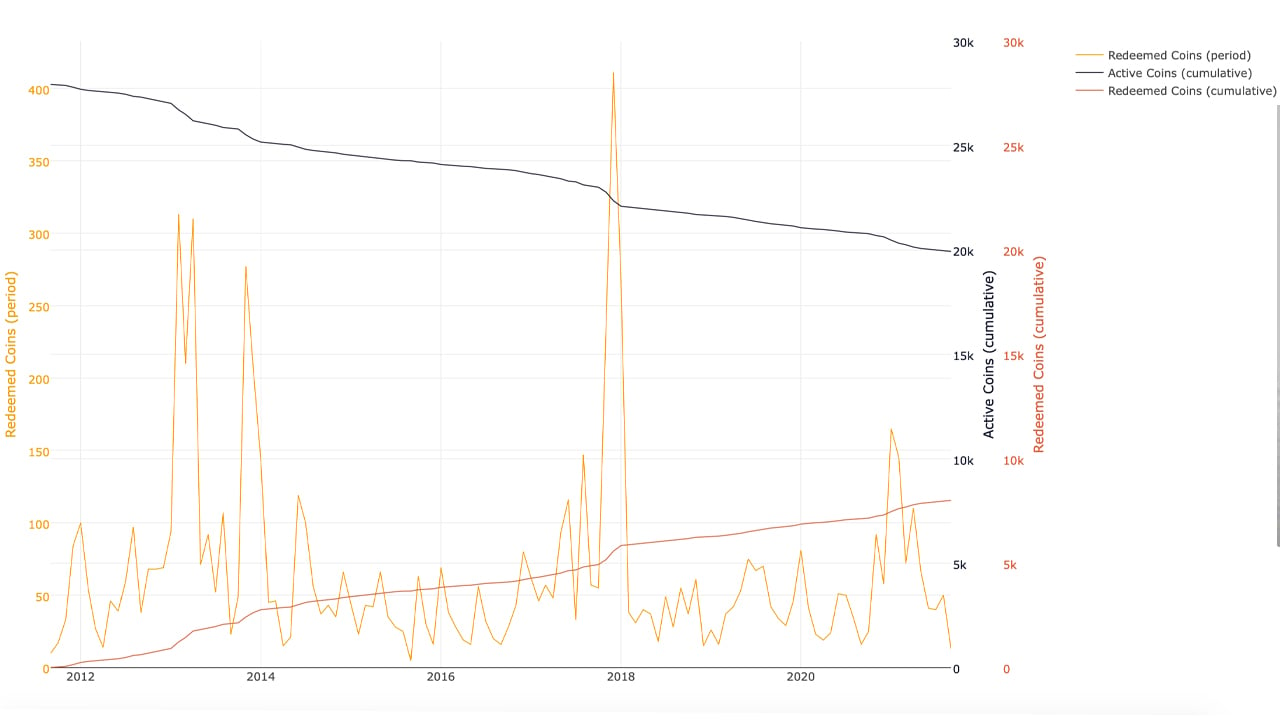

Unfortunately, the U.S. government forced Caldwell to stop minting Casascius bitcoins with loaded BTC on them. By the end of Caldwell’s tenure making these coins, he managed to mint around 27,920 Casascius bitcoins with various increments of loaded BTC. Over the years owners have redeemed the loaded value held on these Casascius bitcoins in a process called a “peel.”

On December 23, 2019, Bitcoin.com News reported on a 100 BTC gold bar that was peeled or redeemed. This means the digital BTC value was spent by the owner and the physical bar is empty with zero digital value left. Ten years after the first Casascius bitcoins were minted, there’s under 20K left that are active with loaded BTC.

19,920 Casascius Physical Bitcoins Left to Peel

According to statistics from casasciustracker.com, on September 18, 2021, there’s approximately 19.92K active Casascius bitcoins waiting to be peeled. So far 8,009 coins or bars have been redeemed over the last ten years and there’s approximately 43K BTC left unpeeled worth over $2 billion.

48,169 BTC worth $2.3 billion has been spent by the peel process. Furthermore, there are some lucky owners who still have yet to peel 1,000 BTC bars or coins worth $48 million using today’s exchange rates. For instance, out of the six 1,000 BTC Series 1 Casascius bitcoins, only 2 have been redeemed so far.

In that same series, Caldwell minted 16 1,000 BTC bars and so far 87.50% or 14 bars have been redeemed. There were 81 Series 2 100 BTC coins (worth $4.8M each) minted by Caldwell and to date 47 coins or 58.02% of the BTC has been redeemed from that minted set.

Today, the Casascius physical bitcoin collection has gathered significant numismatic value and the coins and bars are considered coveted bitcoiner collectibles. Even peeled Casascius bitcoins still hold value and some of them are being sold for $1,999 (for a 2012 piece). A loaded silver Casascius physical bitcoin with 0.1 BTC ($4,834) from 2013 is selling for $20,000 today. A rare unloaded set of 125 Casascius physical bitcoins made of aluminum is selling for $4,995.

What do you think about the fact that there are now less than 20,000 Casascius bitcoins left active today? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment