As the non-fungible token (NFT) space continues to grow, the blockchain analytics Nansen has published a leaderboards list of the top wallets (NFT collectors) that interact with NFTs on a regular basis. The analytics firm combed through 90 million ethereum wallets and found a number of big market players making moves in the NFT space.

The NFT Ecosystem’s Most Prolific Market Collectors

Non-fungible token (NFT) technology and the supporting ecosystem have grown quite mature in 2021 and it doesn’t seem like it’s slowing down anytime soon. There’s lots of NFT market data coming out too and recorded in real-time. Well known brands, celebrities, and popular organizations are jumping into the NFT fray and all of this is recorded in headlines as well.

Data stemming from nonfungible.com’s 30-day market history shows there were $380 million in NFT sales last month. Now the blockchain analytics provider Nansen has provided statistics on some of the most prominent non-fungible token market players, namely the NFT collectors.

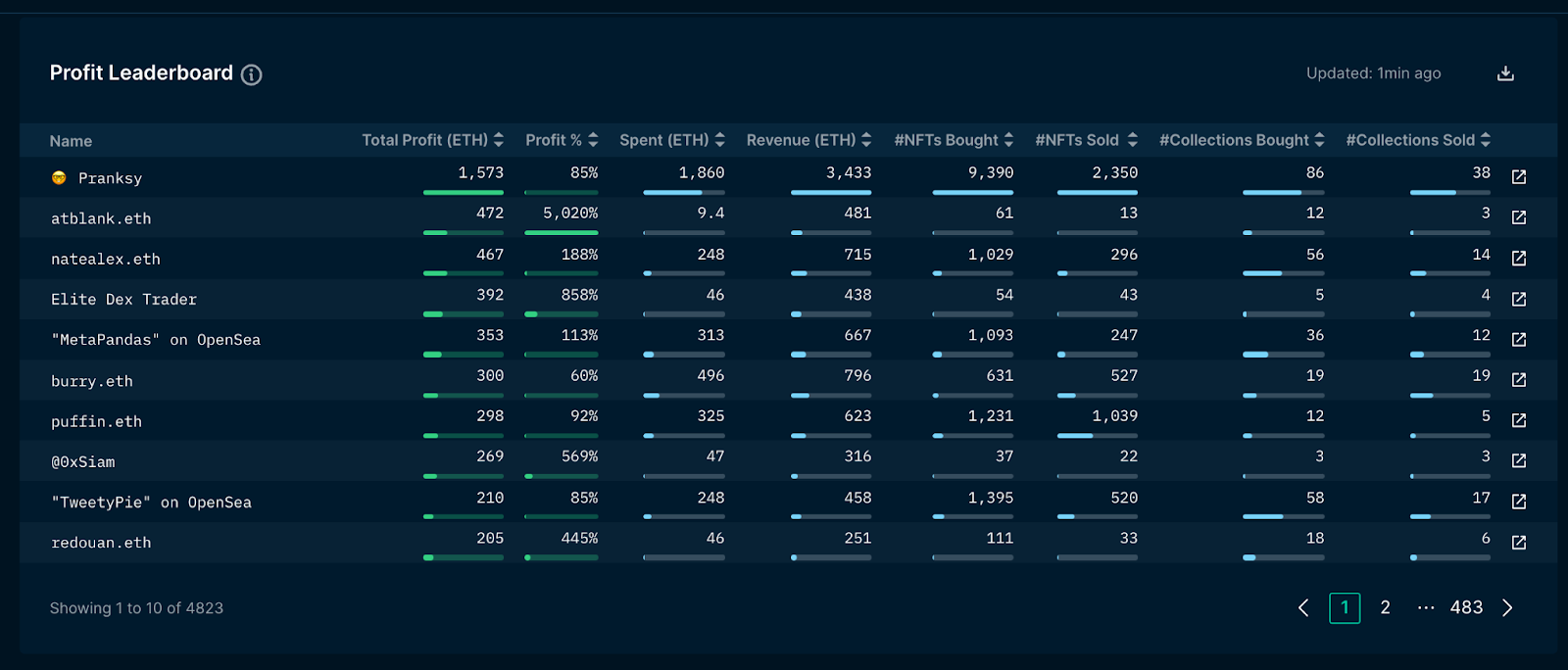

Out of the millions of wallets and transactions scanned, Nansen says that in order to be included on the NFT leaderboard “an account must have bought and sold at least 10 NFTs from over 3 collections.” The leaderboard has different sections which rank by total profit, and leaders of a specific NFT collection. There’s also a tab called the “hodlers tab” in the NFT God Mode section of the leaderboard. The stats Nansen’s leaderboard data shows can be quite interesting and can give some perspective on the top NFT collectors in the space.

Pranksy, Atblank, Natealex, and Snotrocket

For instance, there is the NFT collector dubbed “Pranksy,” who is considered a collector with the best overall profits. “Pranksy is prolific,” Nansen’s report details. “With a total spend of 1860 ETH (currently 3.4 Million USD), Pranksy has spent over 3x the amount of anyone else on the leaderboard,” the researchers add. Pranksy also has covered a lot of collections and spans a total of 86 collections and “in total has purchased 9390 NFTs, of which 2350 have been sold.”

Another player called ”Atblank.eth” has made the best percentage of profit collecting NFTs and is making “5000%+ profit on investment,” according to stats. Another NFT collector called “Danny” is the “biggest spender as the collector has spent 2570 ETH over 7088 NFT purchases. Out of the 7,088 NFTs in Danny’s collection, the collector has only sold 149 according to the Nansen study. Another character dubbed “Snotrocket.eth” is known for having the most NFT collections purchased.

Snotrocket.eth has purchased from 118 different NFT collections and Nansen says the buyer is the “most eclectic.” “Despite this breadth of investment,” Nansen’s report details. Snotrocket.eth has managed to make 145 ETH total profit and only sold 184 out of their 613 NFTs. That degree of total profit is unusual for an NFT collection with such high diversification.” First place goes to Pranksy for “reinvestment” strategies and second place is held by Atblank.eth. Another individual by the name of “Natealex.eth” gets the third-place position for the most consistent returns.

“The NFT leaderboards and wallet profiler represent new ways of gaining insight into the fast-moving and newly emerging NFT ecosystem,” Nansen’s report concludes. “Unlike traditional art-markets, blockchain is able to preserve individual privacy whilst acting as a public treasure-trove of data revealing market trends and buyer strategies. These feature updates enable new and seasoned collectors to curate their own list of notable wallets to develop unique and personal insights into the latest NFT activity.”

What do you think about Nansen’s report on the top NFT market collectors in the space today? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment