Shark Tank star Kevin O’Leary, aka Mr. Wonderful, is increasing his cryptocurrency allocation. He is also taking an equity stake in the FTX crypto exchange and has signed a multi-year deal to become its ambassador and spokesperson. He will be paid in crypto for his services.

Kevin O’Leary Increasing His Crypto Allocation

Shark Tank’s Kevin O’Leary has revealed that he is increasing his cryptocurrency allocation. He tweeted Tuesday:

Finally solved my compliance problems with cryptocurrencies. I’m going to use FTX to increase my allocation and use the platform to manage my portfolios.

His tweet followed FTX Trading Ltd. and West Realm Shires Services Inc., owners and operators of FTX.com and FTX.us respectively, announcing “a long-term relationship” with O’Leary.

Mr. Wonderful will be taking an equity stake in both companies and will be “paid in crypto to serve as an ambassador and spokesperson for FTX,” the announcement details, adding:

He has asked that his compensation for these services be paid in crypto assets and be managed on the FTX platform.

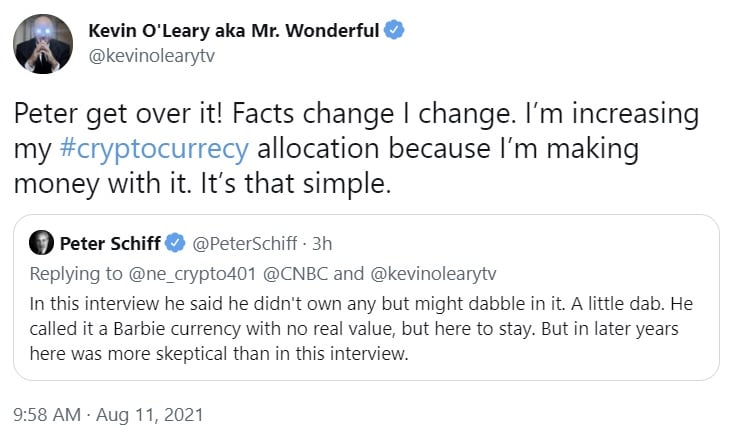

On Wednesday, O’Leary told gold bug Peter Schiff that the reason he is increasing his crypto allocation is because he is making money with it.

Schiff accused CNBC of relentlessly pumping bitcoin when the media network called O’Leary “a long-time crypto proponent.” Schiff claimed: “That’s a lie. He was a long-time crypto skeptic, who recently changed his tune after getting involved in crypto related companies. He’s just a paid shill.”

O’Leary responded by telling Schiff to “get over it,” adding that when facts changed, he changed. The Shark Tank star further revealed, “I’m increasing my cryptocurrency allocation because I’m making money with it. It’s that simple.”

Regarding crypto compliance, O’Leary opined: “Institutional investors struggle with the decision to invest in crypto assets, not because they don’t want to, but because they have difficulty in knowing with certainty that they will be 100% compliant with regulators and reporting requirements. I am no different.” He concluded:

I want to increase my crypto exposure but also serve my compliance mandates.

O’Leary said in February that he invested 3% of his portfolio in bitcoin and ether, noting that cryptocurrencies are “here to stay.”

What do you think about O’Leary increasing his crypto allocation and his deal with FTX? Let us know in the comments section below.

Comments

Post a Comment