Digital currency markets have been gathering gains again moving past the lows seen a few weeks ago. This week crypto traders have been discussing over-the-counter (OTC) desks bubbling with demand for bitcoin as the co-founder of 21st Paradigm explained, “high net worth individuals [and] institutions want your bitcoin.”

Analyst Says Big Market Players ‘Want Your Bitcoin’

Most traders either use decentralized exchange (dex) platforms or centralized exchange (cex) operations to acquire bitcoin (BTC) and a myriad of other digital currencies. However, high-net-worth individuals and institutions usually don’t leverage dex or cex applications, as they choose to trade via over-the-counter (OTC) trading desks. OTC trading or off-exchange trading is trading between two parties directly and usually with help from the OTC desk’s representative. In contrast to trades that take place on cex or dex platforms, these trades are not recorded on order books. Although, transfers from crypto OTC desks can be recorded.

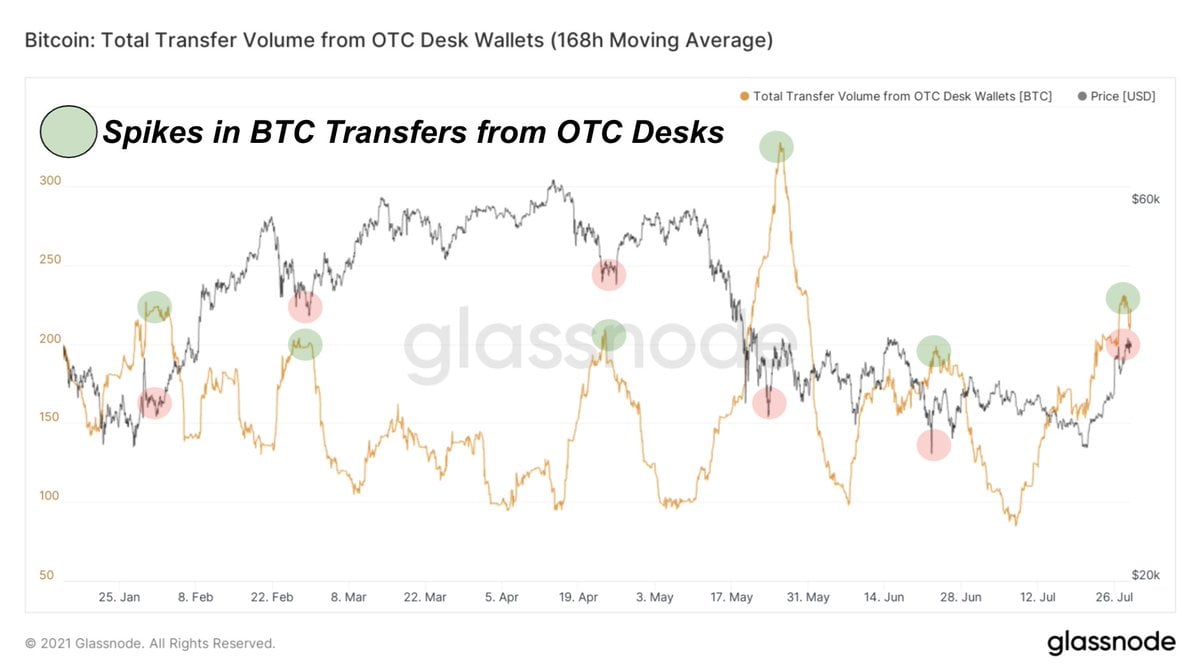

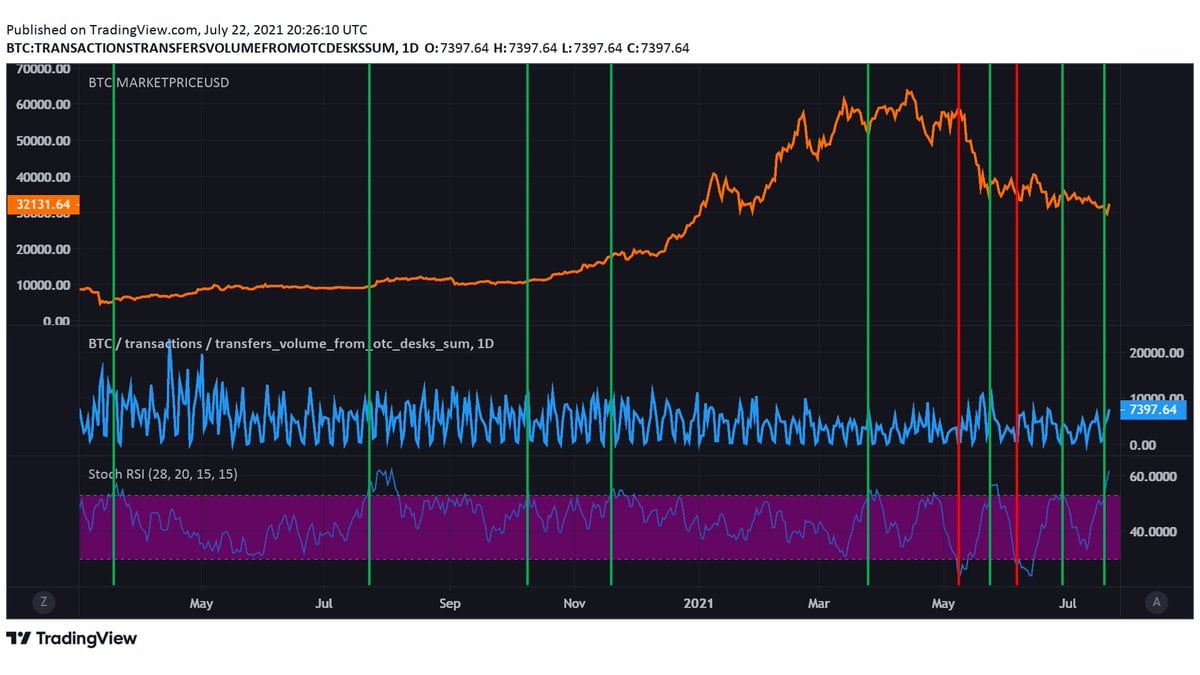

Two days ago, the co-founder of the advisory firm 21st Paradigm, Dylan LeClair, tweeted about some large OTC transfers last week by sharing a chart from Glassnode analytics. “Big transfer volumes from OTC Desks over the last week,” LeClair said at the time. “High net worth individuals [and] institutions want your bitcoin,” he added. Another individual agreed with LeClair and said “Yessssirr,” because the individual, Will Clemente, shared a tweet on July 22 that had shown a similar trend.

“OTC Outflow RSI showing the strongest BTC buy signal since July of last year,” the analyst Will Clemente said to his 158,000 Twitter followers. “This indicates buying from institutions/high-net-worth individuals,” he added. A number of other traders discussing the subject on Twitter agreed with the OTC demand assessment and the social media platform is littered with threads discussing the subject. One individual tweeted:

Noticeable Market Changes During China’s Morning Trading Sessions

A number of other ‘whale-like’ and large purchasing patterns were noticed by bitcoiners observing different metrics. While bitcoin has been rising, traders also suspect that China might be buying bitcoin. There have been a few noticeable market changes during the early morning hours in China, according to Trustnode’s research.

Meanwhile, during the last 24 hours bitcoin (BTC) has consolidated just above the $41K handle and has only moved +0.10% on Sunday, August 1. However, BTC is still up 17% against the U.S. dollar during the last week and 30-day stats show BTC has gained over 22%. Bitcoin had managed to jump above the $42K handle at $42,615 per unit, but has not been able to hold above the $42K zone for long periods of time.

What do you think about the bitcoin OTC demand assessment from traders and analysts on social media? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment