U.S. Senator Patrick Toomey has declared investments in Grayscale’s bitcoin and ethereum trusts. His declaration shortly followed one by fellow congressman, U.S. Representative Barry Moore, who declared that he had invested in dogecoin, ether, and cardano.

Senator Pat Toomey’s Cryptocurrency Investments

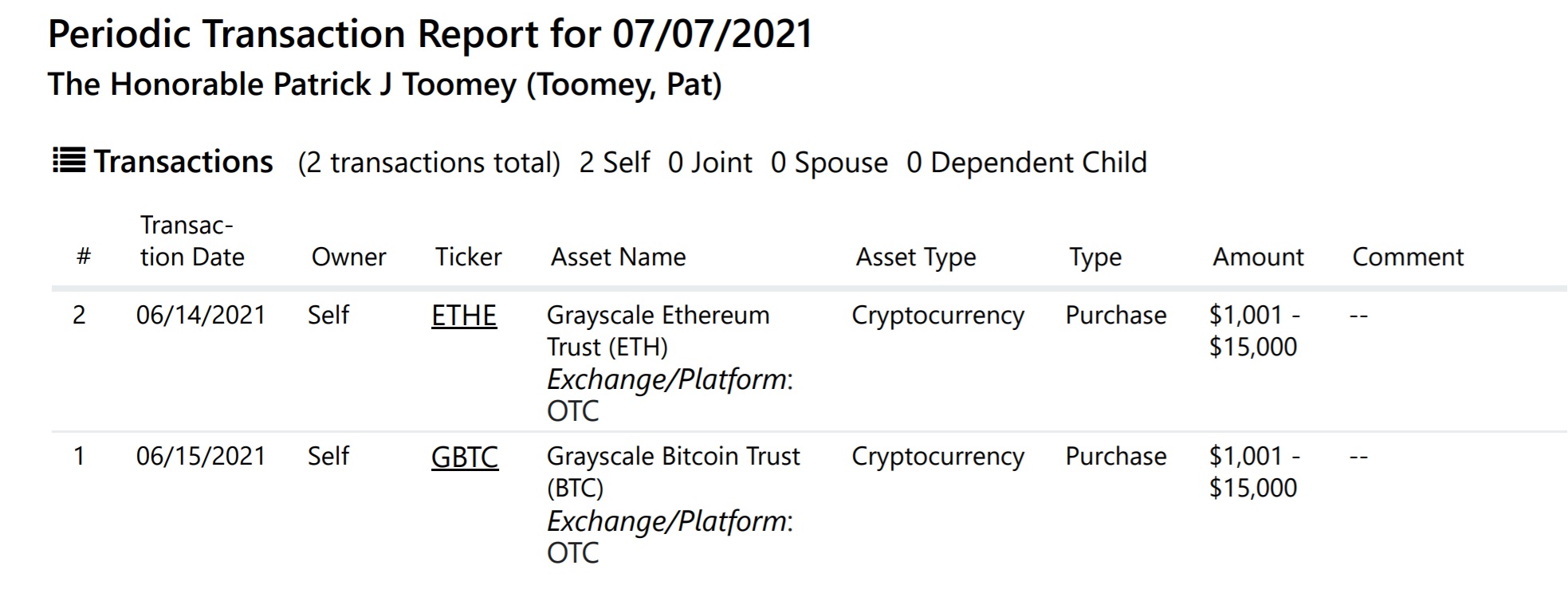

A growing number of U.S. lawmakers are investing in cryptocurrencies or crypto-related investments. According to a Periodic Transaction Report filed on July 7, U.S. Senator Patrick Toomey from Pennsylvania declared two personal cryptocurrency investments, each worth between $1,000 and $15,000. One was in Grayscale Bitcoin Trust (GBTC) and the other in Grayscale Ethereum Trust (ETHE).

The senator’s investments have decreased in value since his purchases. He invested in Grayscale Bitcoin Trust (GBTC) on June 15 when the price was around $33.23. At the time of writing, it has fallen to $27.65. As for his investment in Grayscale Ethereum Trust, the price was $24.45 on June 14 when bought it but has since dropped to $20.41 at the time of writing.

Toomey has recently voiced concerns about crypto regulation. A few days before investing in Grayscale’s bitcoin and ethereum trusts, the senator wrote a letter to Treasury Secretary Janet Yellen urging the Treasury Department to “make significant revisions” to the crypto proposals by the Financial Crimes Enforcement Network (FinCEN). He believes that if the current proposals are adopted, “they would have a detrimental impact on financial technology (fintech), the fundamental privacy of Americans, and efforts to combat illicit activity.” He also raised concerns about FATF’s guidance.

The lawmaker from Pennsylvania is not the only U.S. senator with a bitcoin-related investment. The outspoken pro-bitcoin U.S. Senator Cynthia Lummis from Wyoming owns about five bitcoins. She encouraged “people to buy and hold” BTC. “I encourage them to save bitcoin for their retirement, for their future.”

Recently, U.S. Representative Barry Moore from Alabama also declared his cryptocurrency investments. He bought dogecoin (DOGE), ether (ETH), and cardano (ADA).

What do you think about Senator Pat Toomey investing in bitcoin and ether through Grayscale’s trusts? Let us know in the comments section below.

Comments

Post a Comment