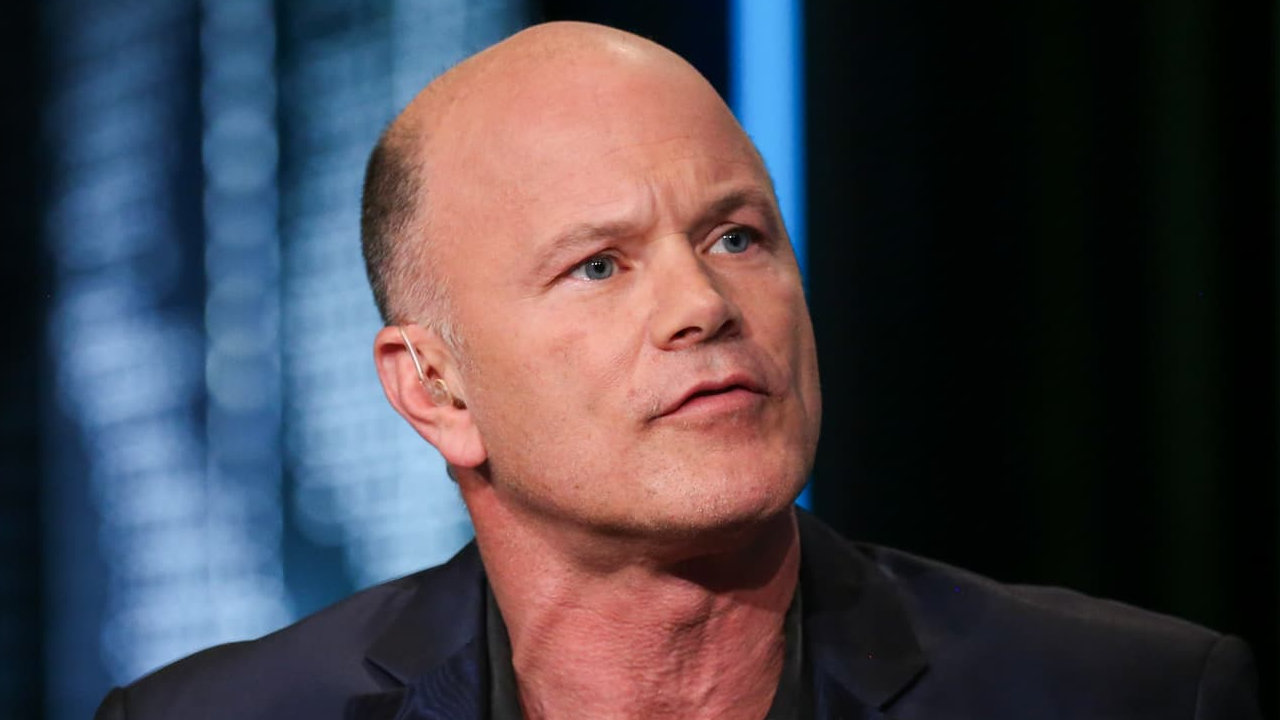

Galaxy Digital CEO Michael Novogratz says that cryptocurrencies, such as bitcoin, have bounced back because institutional investors are buying. Responding to U.S. Senator Elizabeth Warren’s anti-crypto stance, he stated, “We need to do a much better job going to D.C.” to educate lawmakers.

Novogratz Says Institutions Are Buying

Galaxy Digital CEO Mike Novogratz talked about the outlook for bitcoin in an interview with CNBC Wednesday.

He was asked how he sees bitcoin’s price action and what he thinks has been driving the price of the cryptocurrency back to the $40,000 level. The pro-bitcoin executive replied:

Crypto has bounced back because institutions are buying.

He brought up the FTX exchange as an example. The exchange recently raised $900 million from more than 60 investors, putting the company’s valuation at $18 billion. Investors included Softbank Group Corp., venture capital firm Sequoia Capital, private equity giant Thoma Bravo, Daniel Loeb’s Third Point, the Paul Tudor Jones family, and British hedge fund manager Alan Howard.

Novogratz dismissed the explanation that the price hike was due to the news that Amazon may be accepting cryptocurrency payments.

Emphasizing that institutions are some of the smartest investors in the world and they are participating in the crypto space, he said:

That sent a signal to the whole crypto market that this isn’t going away.

“This was partly a big short-covering rally and partly recognition that this is a real market that isn’t going anywhere,” said the Galaxy Digital CEO.

Novogratz was also asked about cryptocurrency regulation and what it could potentially look like in the U.S. particularly after the warnings by Senator Elizabeth Warren.

Warren warned Tuesday that bitcoin’s price fluctuations put retail investors and businesses that accept bitcoin payments at risk. In addition, she claimed that individuals who use bitcoin as money are criminals.

Regarding Senator Warren’s remarks about cryptocurrencies, the Galaxy Digital CEO opined:

It was disappointing. She was supercilious. She was smug. Really disappointed she hadn’t done any work. This is a progressive technology. She is supposed to be a progressive.

“Crypto goes after the rent takers. If you look at defi [decentralized finance]. If you look at the NFT [non-fungible token] revolution. It’s going to empower artists and creators over the people that used to make money off their backs. So, really frustrating and disappointing,” he continued, adding:

It just tells us … We need to do a much better job going to D.C. and educate [lawmakers].

Novogratz also responded to Warren’s anti-cryptocurrency stance on Twitter Tuesday.

“Banks charged $12 billion in overdraft fees, a fortune in ATM fees, a fortune in checking account fees. But you keep going after crypto where saving and money transfer is a fraction of banks. Good job Senator Warren. You really don’t seem so progressive to me,” he tweeted, elaborating:

If banks had the transparency of defi protocols, we would not have had the mortgage crisis. Defi will win because it’s better.

“Atomic settlement. Bearer assets. Composability. Transparency. We just need to solve for KYC which is coming. We need to educate our politicians,” he concluded.

What do you think about Novogratz’s comments? Let us know in the comments section below.

Comments

Post a Comment