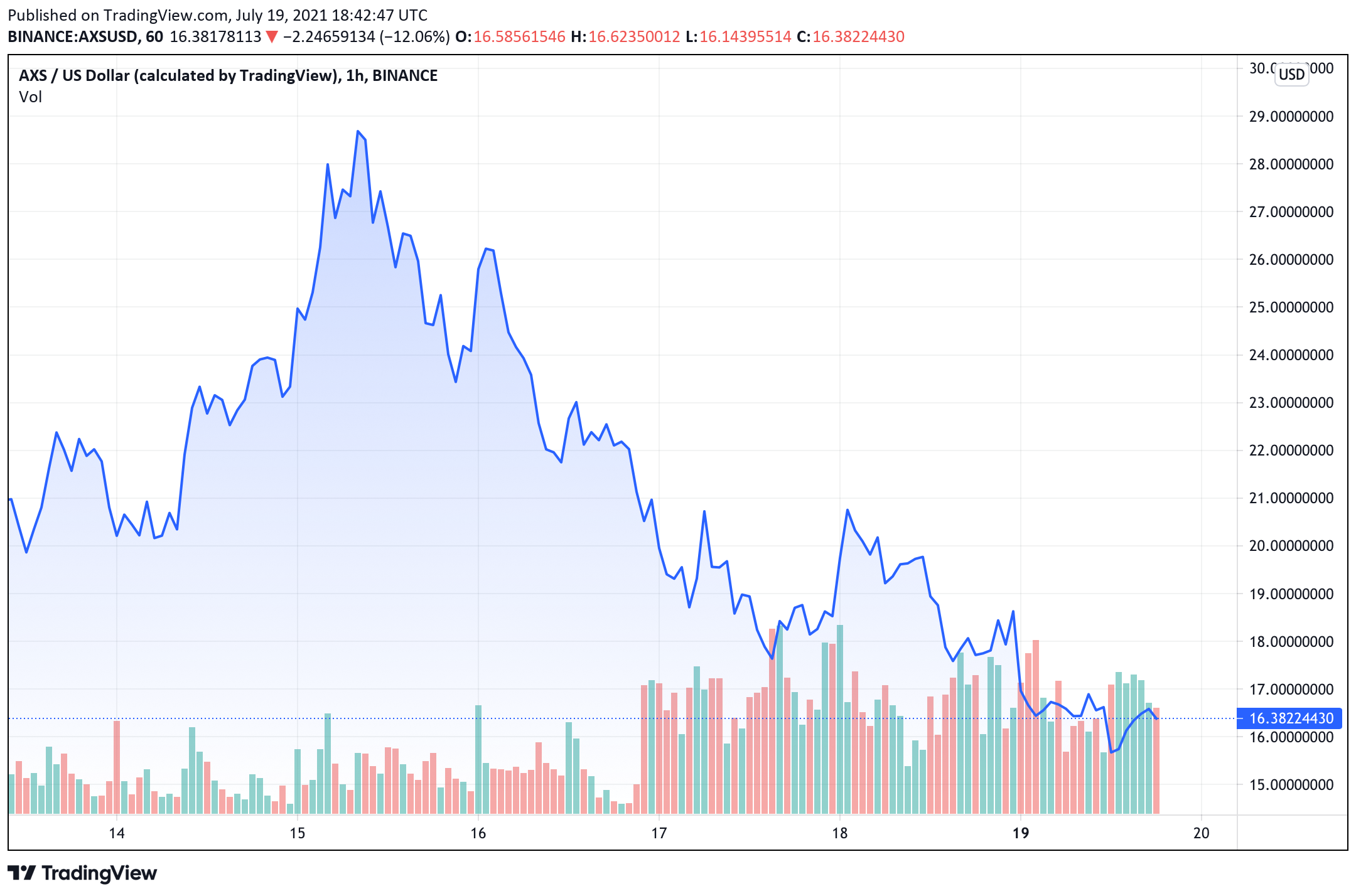

Last week, the game token leveraged within the Axie Infinity gaming universe skyrocketed to all-time highs, while other crypto markets remained extremely lackluster. During the last seven days, Axie Infinity’s platform token has dropped significantly in value shedding more than 12%. Meanwhile, the game platform’s smooth love potion token has slid over 8% over the last 24 hours.

Axie Infinity Down More Than 40% Since All-Time High

Not too long ago, the axie infinity (AXS) token was a topical conversation because it reached an all-time high on July 15. At the time, AXS managed to capture $28.93 per unit and since then it has shed 12.8% during the last seven days.

The axie infinity (AXS) token is used within the blockchain-based game that involves battles between token-based creatures called “Axies.” AXS is used for the game’s governance system as well as other actions within the game. At the time of writing axie infinity (AXS) is exchanging hands for $16.70 per coin.

Another token that’s used within the game is a coin called smooth love potion (SLP) and the crypto asset has also seen its value drop since tapping an all-time high (ATH). However, SLP tapped an ATH two days before AXS did when it reached $0.39 per unit.

While battling in Axie Infinity’s adventure mode, players can earn SLP as rewards. SLP has lost 4.3% during the last week and 24-hour statistics show SLP is down 8.6%. SLP has a market capitalization of $133 million on Monday while AXS commands a market valuation of around $922 million.

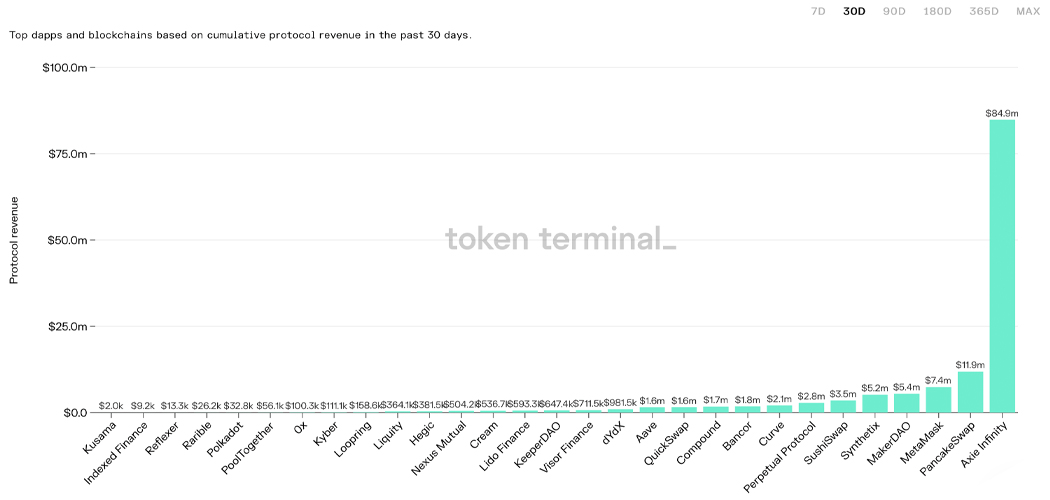

Axie Infinity’s protocol revenue Towers Over Competition, Tether Is Axie Infinity Token’s Biggest Pair Capturing 83% of AXS Trades

Meanwhile, statistics from tokenterminal.com indicate that as far as protocol revenue is concerned, Axie Infinity towers over the competition. Axie Infinity’s protocol revenue eclipses projects like Pancakeswap, Metamask, Maker DAO, Sythetix, and Sushiswap.

While the second-place position Pancakeswap’s 30-day statistics show $11.9 million in protocol revenue, Axie Infinity’s is 84.9 million. Seven-day records show Axie Infinity’s protocol revenue was 38.3 million while Pancakeswap saw $2.3 million. AXS is 42.8% down from the coin’s ATH and SLP is down 38.4% from its ATH.

The biggest pair with AXS on Monday is tether (USDT) as it commands 83.88% of all AXS trades according to cryptocompare.com stats. Tether is followed by BUSD (7.71%), BTC (6.41%), USD (0.97%), and BNB (0.84%). While SLP is down more than 38% today, the token is still up 93.6% during the last three months. AXS has done a lot better as the token is up 87.5% in just two weeks, and three-month data shows AXS is still up 281.4% despite this week’s losses.

What do you think about the Axie Infinity blockchain gaming universe and the project’s associated tokens? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment