A new report shows that U.S. regulators have imposed fines and penalties totaling $2.5 billion on crypto firms and individuals so far. The U.S. Securities and Exchange Commission (SEC) has imposed the most fines, followed by the Commodity Futures Trading Commission (CFTC). Meanwhile, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) is the latest government agency to come after crypto firms.

$2.5 Billion in Fines and Penalties

Blockchain analytics firm Elliptic released a report Monday outlining “crypto enforcement actions by U.S. regulators.” The report explains: “Contrary to the widely-held belief that the cryptoasset industry is unregulated, US regulators are increasingly imposing significant financial penalties on crypto businesses – for fraud, breaches of AML regulations, offering unregistered securities and sanctions violations.”

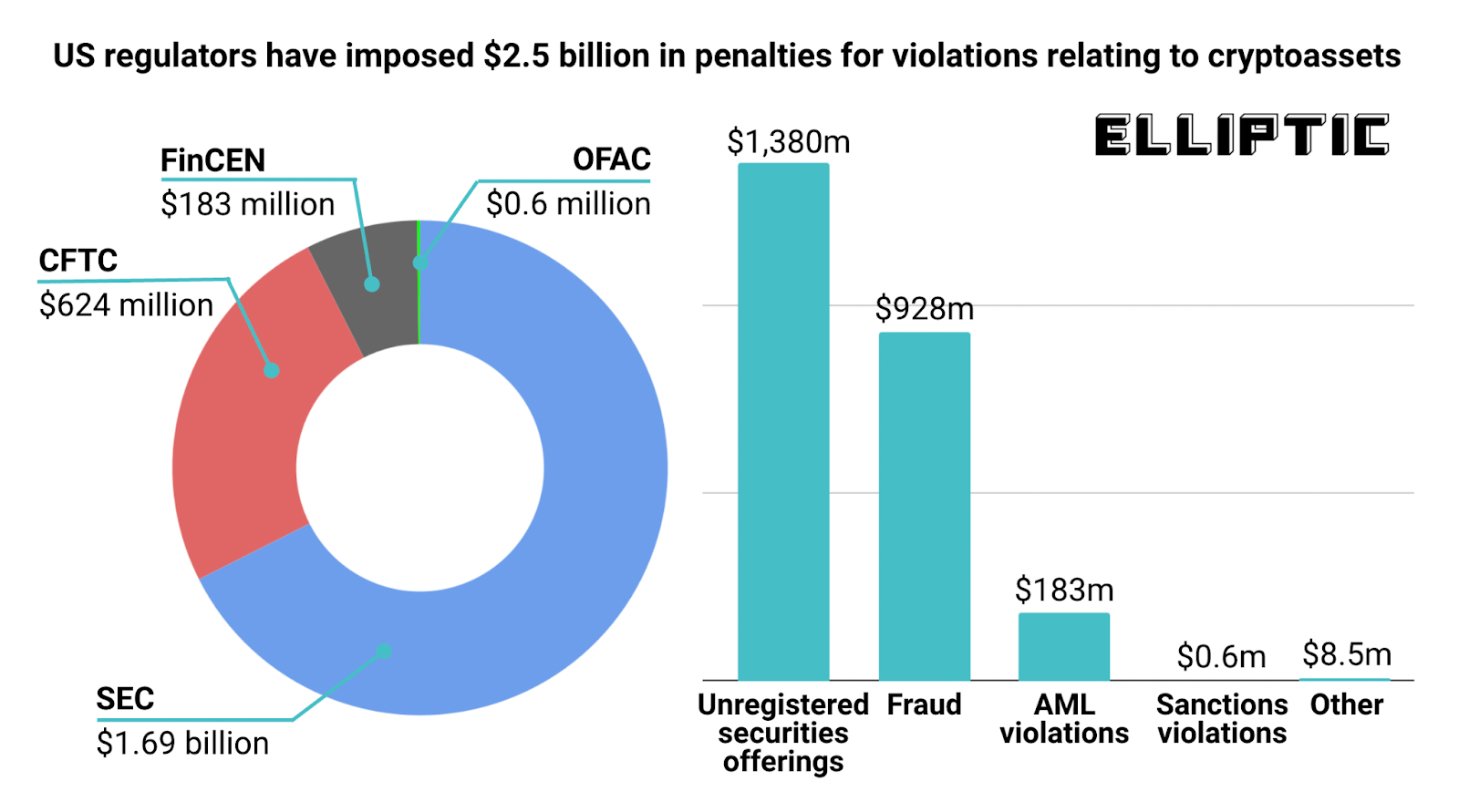

Elliptic analyzed enforcement actions by U.S. regulators since the birth of Bitcoin in 2009 and found that “$2.5 billion in penalties have been imposed against firms and individuals dealing in crypto,” the report details.

The agency which imposed the most crypto-related penalties is the U.S. Securities and Exchange Commission (SEC). Crypto firms and individuals have been asked to pay $1.69 billion by the SEC so far, $1.38 billion of which relate to unregistered security offerings.

The Commodity Futures Trading Commission (CFTC) came second with enforcement actions totaling $624 million. The third is the Financial Crimes Enforcement Network (FinCEN), a unit of the U.S. Treasury Department, with $183 million.

The fourth is the U.S. Treasury’s Office of Foreign Assets Control (OFAC), the latest government agency to take action against crypto businesses. The OFAC has imposed $606K on crypto entities in total. Among companies fined by the OFAC were Bitgo and Bitpay; both allegedly allowed their users to bypass U.S. sanctions.

The largest enforcement action to date was in 2020 against Telegram Group Inc. and its wholly owned subsidiary Ton Issuer Inc., the report notes. The SEC alleged that Telegram’s tokens, called “grams,” were unregistered securities offering. The defendants agreed to return more than $1.2 billion to investors and pay an $18.5 million civil penalty.

The report concludes:

Our analysis of cryptoasset-related enforcement actions in the US, demonstrates that crypto is far from being the ‘wild west’ of finance. Regulators have successfully used existing laws to halt and penalise illicit activity that has exploited cryptoassets.

What do you think about all these enforcement actions by U.S. regulators against crypto firms and individuals? Let us know in the comments section below.

Comments

Post a Comment