A U.S. congressman has called for a law that allows the government to identify cryptocurrency users and reverse crypto transactions. “There’s a significant sentiment, increasing sentiment, in Congress that if you’re participating in an anonymous crypto transaction that you’re a de-facto participant in a criminal conspiracy,” he said.

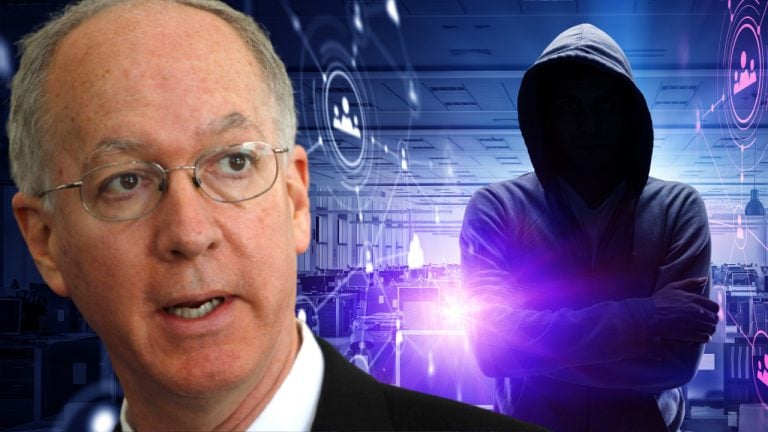

Rep. Bill Foster Stresses the Need for Law to Allow the Government to Reverse Crypto Transactions

Democratic Rep. Bill Foster of Illinois, who is also co-chair of the Congressional Blockchain Caucus, talked about cryptocurrency regulation during an Axios virtual event Tuesday. Addressing the problem of ransomware attacks and how criminals are asking for bitcoin and not cash, the congressman stressed that “there is a fundamental difference between crypto assets and real-world assets. That’s an important distinction that we must make ultimately in the law.”

Emphasizing that laws must be passed to allow federal courts to identify crypto users and reverse transactions in bitcoin or other cryptocurrencies, he said:

You have to be able to go to a court to unmask participants under some circumstances.

He discussed “The condition under which we can reclaim” cryptocurrencies, such as ransoms paid to criminals, noting that it is one of the fundamental decisions which has to be made about crypto assets.

The congressman pointed out that the law needs to address whether cryptocurrency is “truly anonymous or is there a court you can go to, to unmask the participants.” In addition, “is there a court, a third-party, that you can go to, to reverse fraudulent or mistaken transactions.”

Foster gave an example. “If someone dragged you into an alley and put a gun to your head and say get out your cell phone and transfer all your bitcoin to my wallet. Are you just out of luck or can you go to court, have them unmask the participant.” Furthermore, “can the court — if they decide that the transaction was fraudulent, criminal, or mistaken … use its access to very heavily guarded key, cryptographic back door, in a sense, that allows them to cryptographically reverse transactions on a blockchain.”

The lawmaker claims that such tools are necessary for the government to protect itself, the people and companies from ransomware attacks, like the one suffered by Colonial Pipeline.

Rep. Foster opined:

I’ve just said about three things there that will drive the crypto purists berserk, like the trusted third party and so on.

He believes that “For most people, if they are going to have a big part of their net worth tied up in crypto assets, they are going to want to have that security blanket of a trusted third-party that can solve the problem when they get hacked, when they get stolen or even just a mistaken assumption.”

Foster further said that cryptocurrencies must become compliant with federal regulations and laws for them to ever become mainstream instruments for conducting transactions. Replying to a question about how the U.S. would regulate cryptocurrencies given their global and borderless nature, he affirmed, “We’re going to have to establish a law between the legal and illegal regimes here,” elaborating:

There’s a significant sentiment, increasing sentiment, in Congress that if you’re participating in an anonymous crypto transaction that you’re a de-facto participant in a criminal conspiracy.

Many people took to social media to ridicule the congressman and his attempt to reverse bitcoin transactions, stating that he does not understand how bitcoin works. Some responded to Foster’s criminal allegation, stating that they are “not de-facto criminals.”

What do you think about Rep. Foster calling for legislation to give the government power to reverse cryptocurrency transactions? Let us know in the comments section below.

Comments

Post a Comment