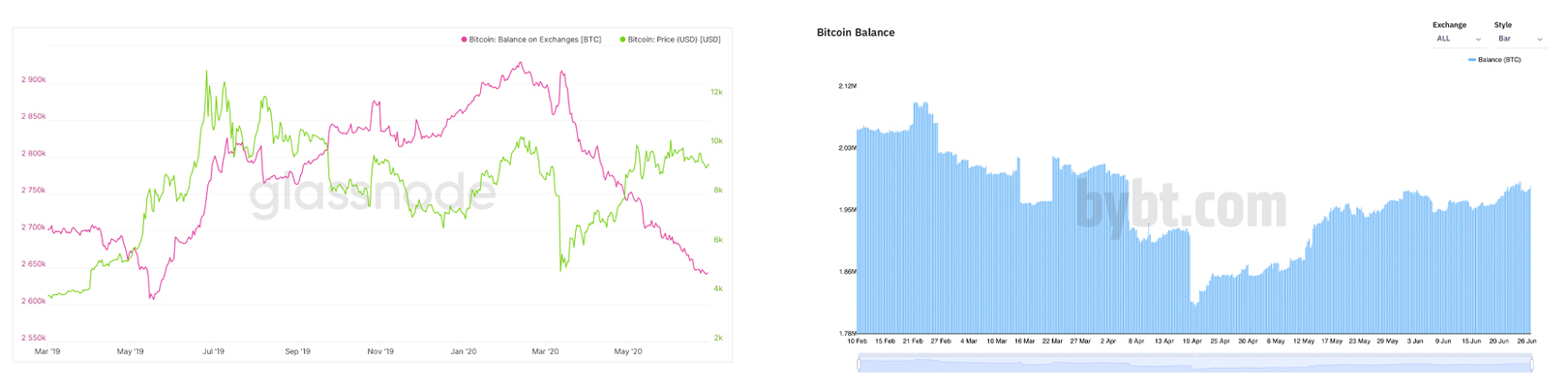

While the price of bitcoin is more than 40% lower than it was 90 days ago on March 29, the number of bitcoin held on exchanges has also been reduced. Last year on the same day in June, 2.79 million bitcoin was retained on crypto trading platforms and a year later roughly 28.67% of the bitcoin held left crypto exchanges. The decreasing quantity of bitcoin kept on centralized exchanges suggests the coins are being held in long-term storage rather than being prepared for trading.

Data Suggests Bitcoins Are Being Removed From Exchanges and Into Noncustodial Wallets for Long Term Storage

On March 29, 2021, the price was 42.93% higher but there was also 9.54% more bitcoin (BTC) held on centralized exchanges. Moreover, the price of BTC was $9,165 per unit, and today as BTC hovers above $33K per unit the price is 262% higher than last year.

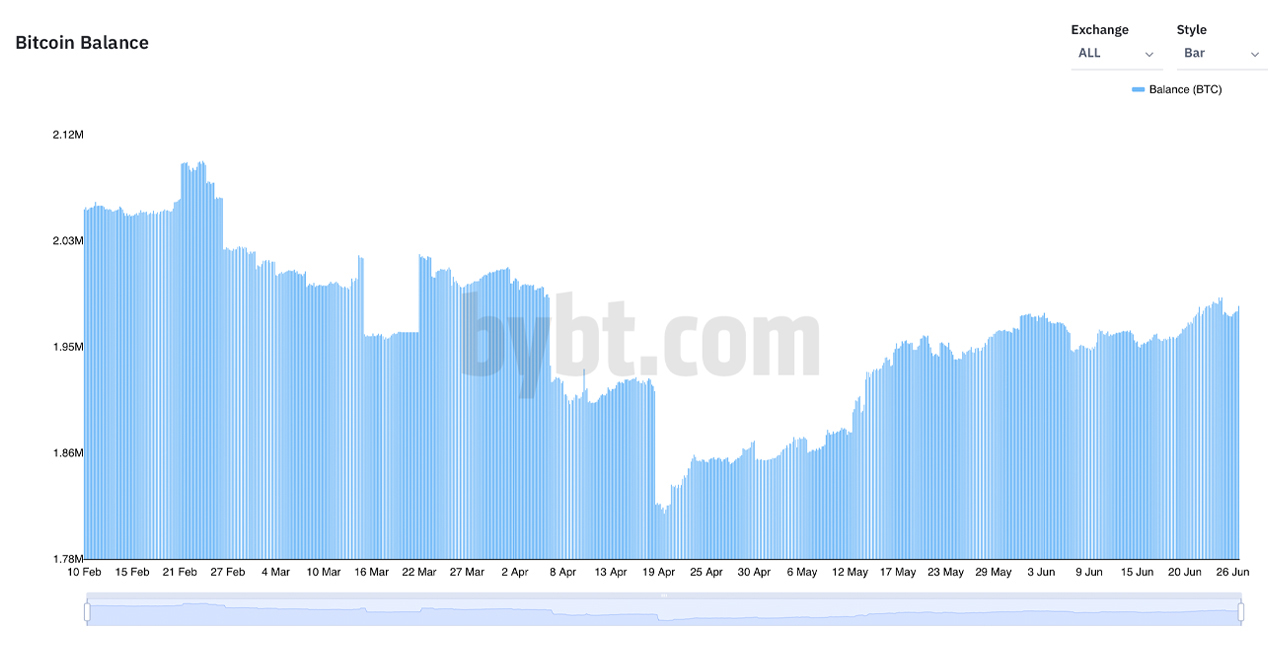

Interestingly, there was a whole lot more bitcoin on exchanges on June 26, 2020, with statistics showing 2.79 million bitcoin was held in exchange reserves. Today, bitcoin held on exchanges is 28% lower with data showing 1.99 million bitcoin on centralized trading platforms.

Last year, Bitcoin.com News reported on exchange balances dropping a month later on July 30, 2020. At that point in time, there was 2.6 million bitcoin on global exchanges and that metric was a 12 month low which fueled bullish optimism.

When bitcoin balances are reduced on centralized exchanges, market participants assume these coins are being held in long-term storage instead of waiting to be sold. Analysts presume that lower selling pressure stems from bitcoin users storing funds in noncustodial private wallets.

However, since April 2021, there’s been an increase in bitcoin held on exchanges as April 20 was the lowest point of the year. On that day, data shows that 1.82 million was held on exchanges and since then balances across the board have spiked by 9.34% to 1.99 million BTC or $62 billion worth using today’s exchange rates.

So as the price has dropped lower in recent times, there’s been a small bump up in exchange deposits, which balances the 90-day drop from March 29 to now. In March 2020, when ‘Black Thursday’ took place there were more than 3 million BTC held on exchanges.

Coinbase Holds the Largest Crypto Reserve Balance With $35 Billion

Statistics show the top exchange with the most bitcoin (BTC) on June 27, 2021, is Coinbase with 636,835 BTC or more than $21 billion in bitcoin reserves. 3,550 BTC or over $117 million left Coinbase during the last 30 days according to bybt.com/balance stats.

Coinbase is followed by Binance (341,722), Okex (323,552), Bitfinex(187,728), Huobi (156,277), Kraken (144,499), and Bitflyer (61,185). Even though Coinbase saw over 3K in BTC leave the exchange, Huobi saw 23,335 BTC or $774 million exit the trading platform during the last month.

Adding stablecoins and ethereum (ETH) into the mix and data from Bituniverse, Peckshield, Chain.info, and Etherscan shows that Coinbase has more than $35 billion in reserves between stables, ETH, and BTC.

With those three metrics combined, the reserve positions by exchange data changes, with Binance ($14.9 billion), Huobi ($12.8 billion), Kraken ($8.64 billion), and Okex ($6.33 billion) following respectively. Last year, those crypto balances held in USD value were much lower than today.

For example, Coinbase’s reserve value was 61% lower in July 2020 and held around $13.6 billion in value with its stablecoin, ETH, and BTC reserves. Binance’s value of the same combination of reserves was 71.40% lower in USD value. Despite the rise in value, at that time last year, both exchanges had more cryptocurrencies held in reserve.

What do you think about the number of bitcoins leaving exchanges? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment