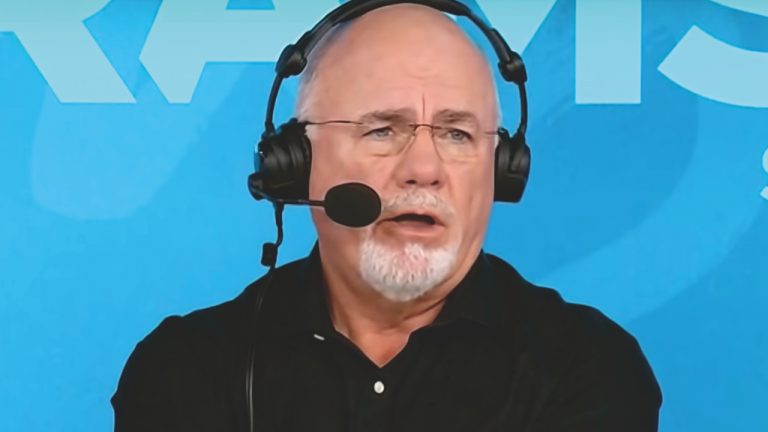

Financial guru Dave Ramsey has given advice on whether one should invest in cryptocurrencies, like bitcoin. Ramsey sees cryptocurrency as a get-rich-quick scheme, preferring to make his money in a “methodical” and “boring” way.

Dave Ramsey’s Advice on Investing in Bitcoin and Other Cryptocurrencies

Dave Ramsey has given advice on cryptocurrency investing. Michael from Dayton, Ohio, called into The Ramsey Show saying that he had been looking into cryptocurrency and asked whether he should be investing in it. The episode, entitled “Should I Invest in Cryptocurrency?” was aired on May 20. Michael is 24 years old and has saved up $3,800 from working his job. He told Ramsey: “I just want to know what are the best investments to really look at and where to go about it.”

The self-proclaimed personal money management expert, Ramsey calls himself “America’s trusted voice on money.” He is the author of seven best-selling books: Financial Peace, More Than Enough, The Total Money Makeover, EntreLeadership, Dave Ramsey’s Complete Guide to Money, The Legacy Journey, and Smart Money Smart Kids. Altogether, they have sold more than 11 million copies.

“You have to set your investment goals with what you believe is your best path to becoming wealthy, otherwise you wouldn’t do the investment, right?” Ramsey began. Michael agreed.

Ramsey proceeded to share his investment experience. “When I was 24, I made a lot of mistakes, buying things that I thought would make me wealthy, quickly and easily,” he detailed, adding that for example, he “bought a lot of nothing-down real estate” and “went broke as a result.”

He also “bought gold futures,” putting all of his $5,000 he had at the time in it. He followed the strategy of a “gold guy,” who “had hit 14 times in a row on his prediction.” Ramsey stood to make $50K if this prediction hit. However, “he missed on that try and my little bitty $5,000 net worth was just evaporated based on my attempt to make $50K in 90 days off of $5,000,” he shared.

Turning to bitcoin and cryptocurrencies, Ramsey described: “Bitcoin’s hot. Crypto’s hot. A lot of people are making a lot of money on it right now.” However, he emphasized: “It is as you said, Michael, very very volatile and so it falls for me, an old guy, under the heading of getting rich quick and I have not found many people that get rich quick. And I don’t like losing money.” Ramsay then advised:

You can certainly do what you want to do but you called here. We do not tell people to invest in highly volatile, unpredictable investments. And currencies of any kind fall in that category. Bitcoin will be the most volatile among those, crypto would be the most volatile among those.

Nonetheless, Ramsey acknowledged that there is a chance of making money with volatile assets. He referenced a guy who called into his show, who put $3,500 into Gamestop and made $50,000. The finance guru commented, “It was interesting to watch from the outside.”

He opined: “I think you’ve got a better shot at bitcoin than you do the lotto, that’s all I’m saying, but both of them are dumb ideas in my mind and I didn’t put any money in either one of them. I’ve never bought a scratch-off ticket in my entire life.”

Reiterating that he just doesn’t like giving his money away, Ramsey said that “If I’m gonna have fun that way, I’m gonna roll down the window, throw $100 bills and cause traffic jams going down the interstate. That’s more fun.” He further noted:

Of course everybody that’s a bitcoin genius right now thinks Dave Ramsey’s an out of touch boomer, which is probably true, but I’m also worth several hundred million dollars so let’s go figure that out.

He then discussed that the investments depend on the investor’s risk tolerance and goal. He proceeded to compare beanie babies to BTC, stating that for him, “that’s right up there in bitcoin.”

“The thing is, Michael, you can invest in whatever you want but the data points tell us that people who do get rich quick don’t. That’s the bottom line,” Ramsey said.

“Out of studying 10,000 millionaires, the number of them that got rich quick is very, very, very small,” he affirmed, adding that they were “methodical and boring and didn’t have a good story to tell their golf course buddy … they just were methodical, they were boring and that’s what I’ve done.”

What do you think about Dave Ramsey’s advice on whether to invest in bitcoin or other cryptocurrencies? Let us know in the comments section below.

Comments

Post a Comment