Investment management firm Ark Invest has highlighted three reasons why the price of ethereum has been hitting record highs. The firm cited increased institutional interest, strong on-chain signals, and imminent protocol upgrades as the key reasons.

Why Ethereum Has Been Going Up

ARK Investment Management, also known as Ark Invest, published a research note last week explaining three key reasons why ethereum is breaking out to new all-time highs.

The first reason the firm’s analyst mentioned was “Increased institutional interest.” Ark Invest pointed out that a number of ether exchange-traded funds (ETFs) have launched in Canada, making it easier for institutional investors to gain exposure to the price of ETH. The note adds:

Institutions and companies like European Investment Bank and Visa have validated the Ethereum blockchain by announcing issuance and settlement use cases, respectively.

At the end of April, the European Investment Bank (EIB), a nonprofit organization and lending arm of the European Union, announced that it has issued a new type of digital bond built using Ethereum. Meanwhile, payments giant Visa announced at the end of March its first transactions settled with Visa in USD Coin (USDC) and transacted over the Ethereum blockchain.

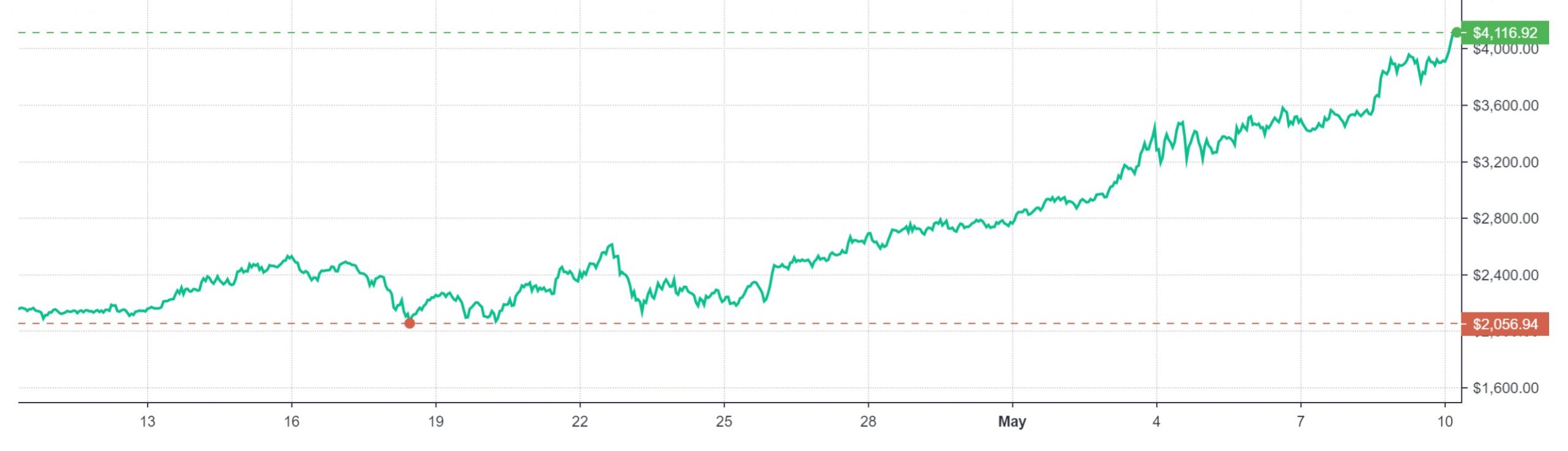

The price of ETH hit another all-time high Sunday night. It is currently $4,116 according to data from markets.Bitcoin.com.

The second reason the analyst noted was “Strong on-chain signals.” The firm explained: “Usage of the Ethereum network is increasing and, by some measures, outpacing that of Bitcoin, as shown by the number of active wallets and total transaction fees,” elaborating:

In our view, decentralized finance (Defi) and non-fungible tokens (NFTs), both of which are burgeoning, explain ethereum’s recent breakout.

The third reason relates to the upcoming protocol upgrades. Noting that the Ethereum Improvement Proposal 1559, which is planned for July, will significantly change Ethereum’s transaction fee model, the note details:

Aiming to lower the volatility of Ethereum’s fees, EIP-1559 introduces a mechanism to burn some transaction fees, detracting from circulating supply and introducing deflation to the Ethereum ecosystem. The impact on ether’s price could be like that associated with a Bitcoin halving event.

What do you think about Ark Invest’s explanation of why ether has been rallying and hitting all-time highs? Let us know in the comments section below.

Comments

Post a Comment