Deutsche Bank has published a report stating that bitcoin is too important to ignore, noting that it is now the third-largest currency in terms of the total value in circulation. In addition, the bank says that governments and central banks know that cryptocurrencies are here to stay and are expected to start regulating the industry this year.

Bitcoin Is Too Important to Ignore

Deutsche Bank Research published a report last week entitled: “Bitcoins: Can the Tinkerbell Effect Become a Self-Fulfilling Prophecy?” It is part three of “The Future of Payments: Series 2.” The report author, research analyst Marion Laboure, Ph.D., wrote:

Bitcoin’s market cap of $1 trillion makes it too important to ignore. As long as asset managers and companies continue to enter the market, bitcoin prices could continue to rise.

At the time of writing, the price of bitcoin stands at $57,455 and the cryptocurrency’s market cap is approximately $1.07 trillion based on data from markets.Bitcoin.com.

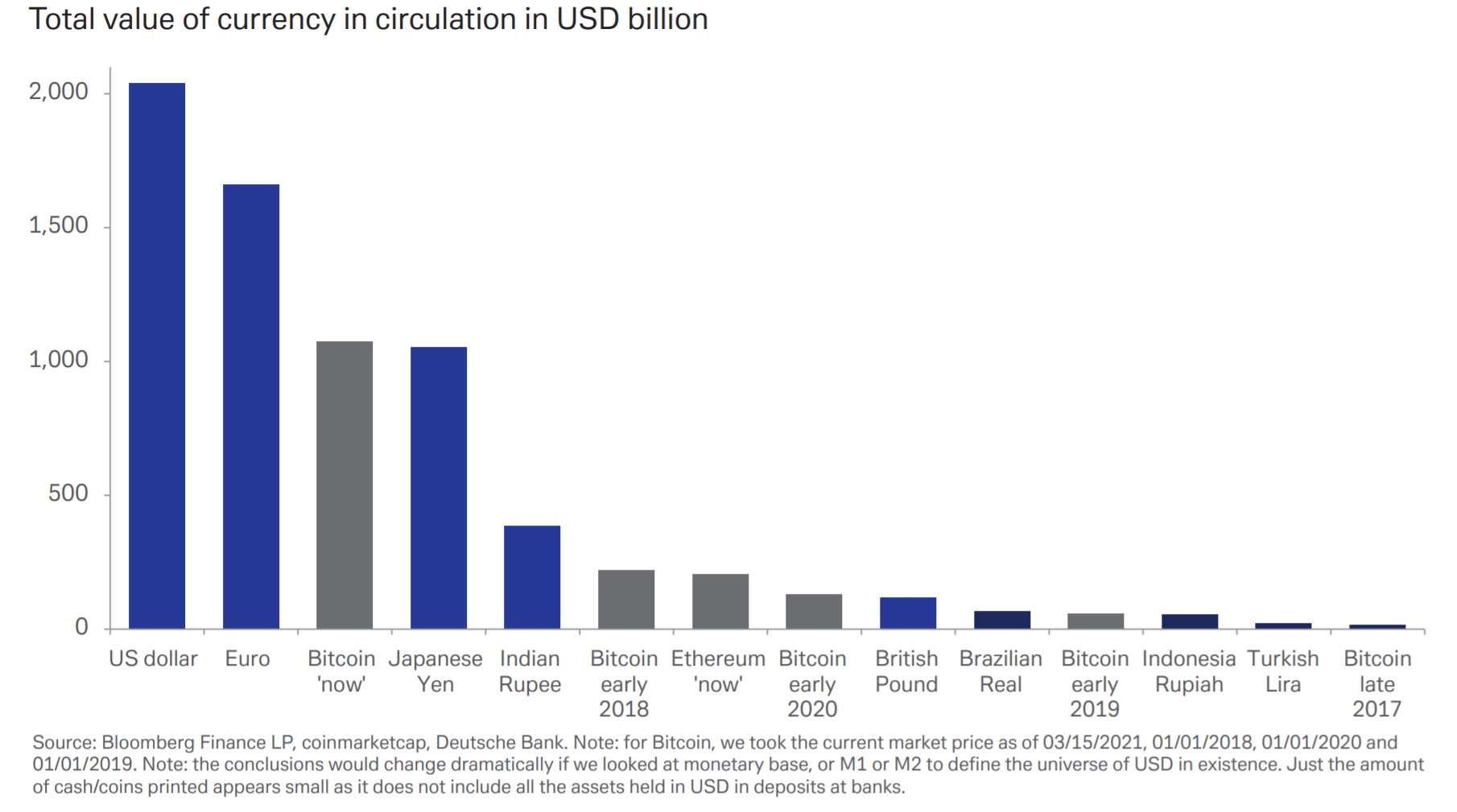

The report also discusses bitcoin as a commodity, currency, and equity. While noting that “bitcoin transactions and tradability are still limited,” the report states that the cryptocurrency’s “market cap is among the top ten, both as a currency and as a stock.” Comparing bitcoin to fiat currencies, the report details:

In terms of total currency in circulation, bitcoin is the third-largest in the world, after the US dollar and the euro.

“This is mainly due to the vast increase in bitcoin’s value recently,” the report continues, adding that “In early 2019, bitcoin represented ‘only’ 3% of the US dollars in circulation, but in February 2021 it surged beyond 40% of the US dollars in circulation.” The fourth-largest currency, according to Deutsche Bank Research, is the Japanese yen, followed by the Indian rupee.

Laboure asserted that “Bitcoin’s value will continue to rise and fall depending on what people believe it is worth.” She explained that “This is sometimes called the Tinkerbell Effect,” which is “a recognised economic term stating that the more people believe in something, the likelier it is to happen based on Peter Pan’s assertion that Tinkerbell exists because children believe she exists.”

Furthermore, the Deutsche Bank analyst opined:

Central banks and governments understand that cryptocurrencies are here to stay, so they are expected to start regulating crypto-assets late this year or early next year.

The Deutsche Bank report also notes that central banks “are also speeding up research on their own central bank digital currencies (CBDCs) and launching pilots.”

Laboure proceeded to discuss the future of bitcoin. In the short term, she said, “bitcoin is here to stay and its value will remain volatile.”

In the medium to long run, the analyst believes that “due to very strong network effects, there will likely be little room for using cryptocurrencies as a widespread means of payment.” Moreover, she cautioned that in the long term, bitcoin “will have to transform potential into results to sustain its value proposition,” elaborating:

In the long run, central banks are unlikely to give up their monopolies. And as long as governments and central banks exist and hold the power to regulate money, there will be little room for bitcoin—as a means of payment—to replace traditional currencies.

What do you think about Deutsche Bank’s view on bitcoin? Let us know in the comments section below.

Comments

Post a Comment