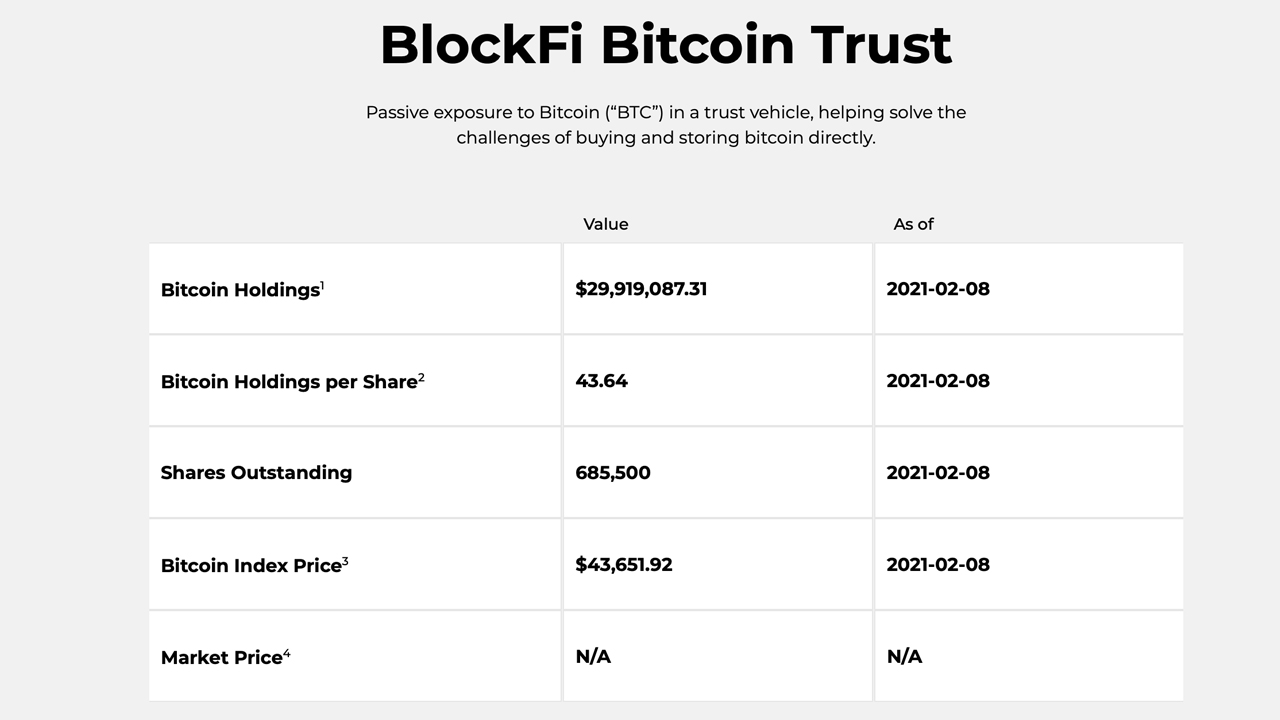

The cryptocurrency financial services firm Blockfi has launched a bitcoin-based trust that offers custody from Fidelity Digital Asset Services. Blockfi’s investment vehicle aims to give investors exposure to the leading crypto asset as bitcoin assets under management (AUM) was over $29 million on February 8, 2021.

Blockfi Launches a Competitive Bitcoin Trust With a Sponsor Fee of 1.75%

On Tuesday, the lender and financial services company Blockfi launched its bitcoin trust as it is managed by Blockfi Management LLC, a wholly-owned subsidiary of Blockfi.

The trust will charge a sponsor fee of 1.75% and the company leverages custodial services from Fidelity’s crypto arm. According to the announcement, the company will use Coin Metrics’ index services and pricing data. The company Grant Thornton LLP will be the Blockfi Bitcoin Trust’s financial auditor.

Blockfi’s trust will compete with Grayscale’s Bitcoin Trust (GBTC) and it offers an annual fee that is .25% lower than GBTC’s fee rating. There are approximately 685,500 shares outstanding and each share represents 43.64 BTC according to Feb. 8 2021 data.

“Given the level of institutional activity in recent months and demand for new, professional-grade investment vehicles, the timing of Blockfi Bitcoin Trust is ideal,” Zac Prince, the founder and CEO of Blockfi said during the announcement.

Prince added:

As we work to broaden the availability of this vehicle to retail brokerages, we expect this product will facilitate greater investments in digital assets – at the core of Blockfi’s mission in bridging crypto with traditional finance.

Fidelity Digital Assets Sees the Need for a More Diversified Set of Products Offering Exposure to the Asset

The recent Blockfi news follows the company’s Visa credit card launch that offers BTC rewards. Furthermore, a few days prior in December 2020, Blockfi launched a cryptocurrency trading platform. As far as Blockfi’s trust is concerned, Fidelity Digital Assets looks forward to its partnership with the crypto financial services firm.

“The digital asset ecosystem has grown significantly in recent years, creating an even more robust marketplace for investors and accelerating demand among institutions,” the head of sales and marketing for Fidelity Digital Assets, Christine Sandler said.

Sandler continued:

An increasingly wide range of investors seeking access to bitcoin has emphasized the need for a more diversified set of products offering exposure to the asset. Like Blockfi, we believe pairing innovative products with institutional-grade solutions that provide high caliber security will help enable broader adoption of digital assets.

Blockfi is not the only competitor trying to compete with Grayscale’s bitcoin trust product, as the crypto asset manager Bitwise recently filed to publicly trade its bitcoin fund. On February 2, 2021, Bitwise Asset Management, announced it had filed a Form 211 with the U.S. Financial Industry Regulatory Authority (FINRA) for the Bitwise Bitcoin Fund (BBF).

What do you think about Blockfi launching a bitcoin trust? Let us know what you think about this subject in the comments section below.

Comments

Post a Comment