Central Bank of Nigeria Orders Banks to Close Accounts of Crypto Clients as Remittances via Traditional Corridors Drop by 97%

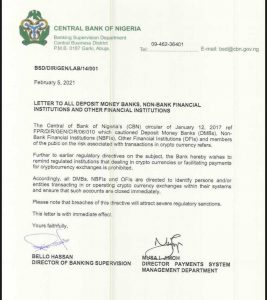

The Central Bank of Nigeria (CBN) has circulated a letter directing banks and financial institutions to identify and close accounts of cryptocurrency transacting entities. The directive, which took immediate effect, threatens “severe regulatory sanctions” to financial institutions that fail to comply.

Banks Taking Immediate Action

Immediately following the letter’s publication, some banks and other financial service providers began complying with the directive. The CEO of Binance, Changpeng Zhao, tweeted that his company had received word from its Nigerian partners confirming that “Naira deposits and withdrawals will be affected.” Other crypto startups like Quidax, Buycoins Africa, and Bundle have said they will obey the directive.

Meanwhile, the Nigerian crypto community is responding to the directive with anger and many are calling the decision retrogressive. Senator Ihenyen, the president of the Stakeholders in Blockchain Technology Association of Nigeria (SIBAN), says the CBN needs to explain the decision especially now after the letter briefly “disappeared” on the CBN website. At the time of writing, an amended version of the letter appeared in place of the original one which had typos.

A ‘Lazy’ Decision

In the meantime, Ihenyen says it is “poor orientation” for banks and other financial institutions to simply block clients based on the CBN letter alone. The SIBAN president also suggests that the CBN may not have “the statutory or regulatory power to simply order banks to deny banking services to a set of persons or an entire emerging industry.”

Ihenyen continues:

As I understand it, CBN can only regulate how banking services can be offered to these persons, applying risks management, such as KYC, AML/CFT regulations. Total ban, unlike its January 2017 letter, is arbitrary, illegal, irresponsible, and with all due respect rather lazy.

While some commentators have suggested that the CBN has simply recycled its directive from 2017, Ihenyen says this view is a “mistaken” one. According to the SIBAN president, who is also a lawyer, “the 2017 directive frowned at transacting in cryptocurrencies in Nigeria and completely restricted banks and other financial institutions from trading in cryptocurrencies.”

However, the same 2017 directive “gave the same banks and financial institutions the leeway to render banking services to cryptocurrency exchanges and traders on the condition that KYC/AML policies are applied.” The latest directive, unlike that of 2017, “completely bans banks and other financial institutions from rendering banking services to persons involved in cryptocurrency trading and entities involved in cryptocurrency exchange.”

Dropping Inflow of Remittances

Although it is not clear what may have prompted the abrupt CBN decision, there is speculation that the central bank is striking back at an industry which may be reducing its influence. This is the view that is shared by Nathaniel Luz, the leader of Dash in Nigeria. Luz explains to news.Bitcoin.com that the drop in remittances (a vital source of foreign exchange) could be one of the reasons.

As data from Nairalytics shows, remittances sent to Nigeria via traditional corridors have been declining from the January 2020 figure of $2.05 billion to the $54.4 million that was received by September in the same year. According to Luz, since many Nigerians are now switching to crypto-based remittance channels, the CBN is now fighting back with this latest directive.

Still, others have speculated that the CBN directive could be an attempt to pre-empt the repeat of protests similar to the one that was spearheaded by the Endsars movement. When authorities attempted to suffocate the protest by freezing Endsars’ bank accounts, protest leaders began to ask for donations in bitcoin.

Meanwhile, some crypto influencers say they want to engage the CBN about the directive which appears to contradict the stance that has been taken by another Nigerian regulator, the Securities and Exchange Commission (SEC) of Nigeria. At the time of writing, the CBN has not issued any other statement beyond the letter. News.Bitcoin.com will be giving updates as more information becomes available.

What do you think of this decision by the CBN? You can share your thoughts in the comments section below.

Comments

Post a Comment