While bitcoin has crossed a new all-time price high in 2021, traders are leery toward shorting the crypto asset. Data from Bitfinex shows the number of short contracts has been extremely low in comparison to the total number of shorts in mid-March 2020. On Saturday, January 2, 2021, when the price of bitcoin surpassed $33k, over 100 million dollars in short positions were liquidated in a matter of minutes.

On Saturday, during the afternoon trading sessions (EST), bitcoin (BTC) reached $33,333 per unit. The price is a lifetime high, in terms of fiat value, during the course of the crypto asset’s 12-year existence. Bitcoin’s value has also increased a great deal since March 12, 2020, otherwise known as ‘Black Thursday.’ Since that day, the price of BTC has risen over 777% outshining nearly every asset under the sun, besides a few other crypto assets.

Liquidated short on XBTUSD: Buy 10,000,000 @ 30864 🏅🏆💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯💯 ~ I'm shocked, shocked to find that gambling is going on in here!

— REKT (@BXRekt) January 2, 2021

Since bitcoin has been rising immensely in value, traders have not been willing to short the crypto asset since mid-March. For instance, on the trading exchange Bitfinex, the number of short contracts have dropped 77% since mid-March 2020. This action can be seen across a myriad of other cryptocurrency exchanges including Bitmex, Bybit, and other platforms that offer margin and leverage trades. Shorts contracts across the board have dropped considerably.

#bitcoin shorters be like

OH NO OH NO OH NO NO NO NO NO— CryptoKid (@mancryptodude) January 2, 2021

Despite the lower activity of short contracts on Bitfinex, the number of longs has not increased a great deal either. In fact, since April 2020, the number of long contracts hosted on the platform have also plummeted. The shorts and longs staying fairly low, suggests traders are uncertain on how to place their bets in accordance with future BTC prices.

Meanwhile, those traders who are willing to short bitcoin (BTC) during this impressive bull run, have lost their shirts many times on the way up. One example is when BTC crossed the $20k all-time high two weeks ago, around 74,000 short positions got liquidated that day. At the time, the derivatives exchange Bybit’s liquidation data explained that it saw a whopping $1 billion in liquidations and roughly 98% of the trades were shorts.

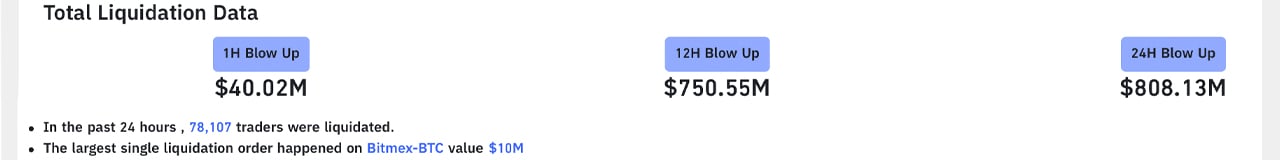

Today’s rise over the $33k price zone has been no different, as 78,107 traders were liquidated according to Bybit data on Saturday. The largest single liquidation order happened on Bitmex-BTC this morning (EST), with a value of around $10 million. Over $800 million contracts were liquidated during the last 24 hours of crypto trading.

The popular Twitter account dubbed ‘Rekt’ recorded the $100 million worth of liquidations at $30,864 per unit price. “Liquidated short on XBTUSD: Buy 10,000,000 @ 30,864,” Rekt tweeted. “I’m shocked, shocked to find that gambling is going on in here,” he added.

What do you think about the lower activity of bitcoin shorters and the liquidations after bitcoin’s all-time highs? Let us know what you think about this subject in the comments section below.

The post While Bitcoin Tapped New Price Highs, 78,000 Short Positions Worth Over $800 Million Got Liquidated appeared first on Bitcoin News.

Comments

Post a Comment