Middle Eastern crypto exchange Coinmena said this week that it had obtained a crypto assets services company license from the Central Bank of Bahrain (CBB) ahead of its planned launch.

In receiving the license, the exchange, which has been certified by the Shariyah Review Bureau, said it had met several technical, operational, and security requirements from the CBB.

Coinmena added that the license allows it to operate as a regulated and onshore platform, becoming one of only a few fully licensed and operating crypto exchanges in the Middle East and North Africa (Mena) region,

At launch, Coinmena plans to offer spot trading in five major crypto assets – bitcoin (BTC), ethereum (ETH), ripple (XRP), bitcoin cash (BCH), and litecoin (LTC) to both retail and institutional investors. It will also host an over-the-counter (OTC) desk for larger transactions.

The exchange did not provide a date for its planned launch. Its services will be available to investors in Bahrain, the United Arab Emirates, Saudi Arabia, Kuwait, and Oman, it said in a Jan. 24 statement.

Dina Sam’an, co-founder and managing director of Coinmena, detailed:

Obtaining the license from the Central Bank of Bahrain allows us to operate under one of the most robust and globally-renowned digital assets regulatory frameworks where governance, security, and customer protection are central to all our operations.

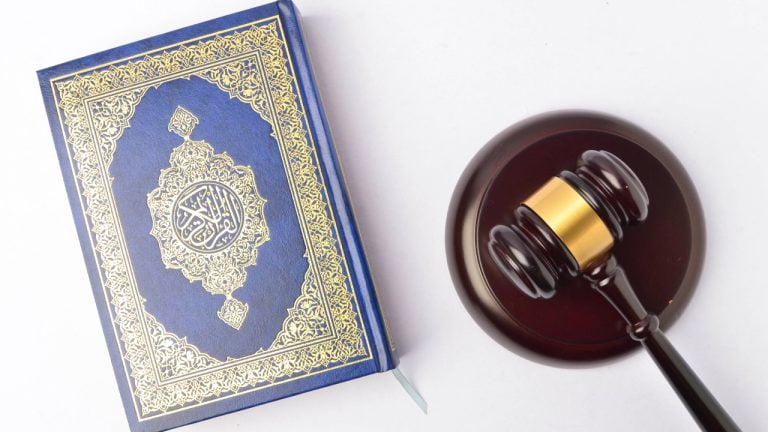

Shariah compliance is a key customer need and regulatory requirement in most Muslim markets. As regards bitcoin, the technology has been viewed as “haram” – meaning that it is prohibited under Shariah laws on the basis that cryptocurrencies may be used for illegal activities such as money laundering and fraud, according to some experts.

There is also concern over a lack of central authority and how that cryptocurrency strip governments and central banks of their power over national monetary systems.

What do you think about Coinmena’s licensing by the Central Bank of Bahrain? Let us know in the comments section below.

Comments

Post a Comment